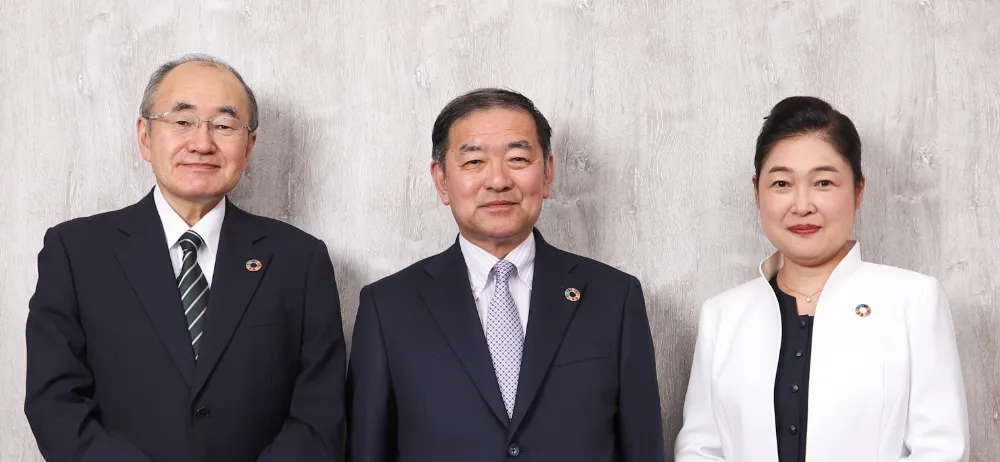

Discussion between Outside Directors

Progress of governance reform from an external perspective

Kenichi Naito

Independent Outside Director, Audit and Supervisory Committee Member

Joined Ube Industries, Ltd. (currently UBE Corporation)

General Manager of Administration Dept., Ube Techno Eng Co., Ltd. (currently UBE MACHINERY CORPORATION, Ltd.)

Director, General Manager of Administration Center, Ube Techno Eng Co., Ltd.

Managing Director, Executive General Manager of Administration Dept., T&U ELECTRONICS CO., LTD.

Auditor, UBE EXSYMO CO., LTD.

Director, TS TECH (Audit and Supervisory Committee Member) (incumbent)

Hajime Hayashi

Independent Outside Director, Audit and Supervisory Committee Member (Chairperson of the Nomination and Compensation Committee)

Joined Mie Labor Management Center

Registered as an attorney, joined Owaki & Sumi Law Office

Joined Meiwa Law Office

Representative of Sazanka Law Office (incumbent)

Auditor, TS TECH

Director, TS TECH (Audit and Supervisory Committee Member) (incumbent)

Chairperson of the Nomination and Compensation Committee,

TS TECH (incumbent)

Tomoko Nakada

Independent Outside Director, Audit and Supervisory Committee Member

Assistant Judge (Tokyo District Court)

Registered as an attorney (affiliated with Dai-ni Tokyo Bar Association)

Registered as an attorney (New York State)

International Fellow of the American College of Trust and Estate Counsel (incumbent)

Academician of the International Academy of Estate and Trust Law (incumbent)

Representative of Tokyo Heritage Law Firm (incumbent)

Director, TS TECH (Audit and Supervisory Committee Member) (incumbent)

Outside Director and Audit & Supervisory Committee Member,

ADVANTEST CORPORATION (incumbent)

Board of Directors continues to evolve, placing importance on diversity

Hayashi: Looking back at our corporate governance reforms, since the appointment of an outside director as chairman of the Board of Directors in fiscal 2021, we have been steadily evolving our governance functions year by year. Key events include transitioning to a company with an Audit and Supervisory Committee and establishing a Nomination and Compensation Committee in fiscal 2022, and Tomoko Nakada becoming our first female outside director. There are a variety of approaches to governance reform, but I believe that strengthening the role of outside directors is one of the most important factors that contributes to ensuring the soundness and transparency of management. The company introduced an outside director system in fiscal 2016. However, in today’s rapidly changing business environment, I feel that it is becoming increasingly important to ensure diversity among our directors, to incorporate multifaceted knowledge, and to make swift and accurate management decisions.

Nakada: When I was first appointed as a director, although outside directors did make statements, I would not say that lively discussions took place. Subsequently, Kaori Matsushita, who has been involved in promoting diversity by utilizing diverse human resources, Kenichi Naito, who served as an auditor at a manufacturer, and Hiromi Wada, who has been active on the front lines of product development, have all become directors. Drawing on their respective areas of expertise, they have been actively speaking out, and the frequency of comments from outside directors has now increased dramatically. Director Hajime Hayashi, a lawyer, expresses his strong opinions from a legal perspective at crucial times without being swayed by those around him. I, as a lawyer too, serve as an outside director for another company and make recommendations not only from the perspective of the law but also from the perspectives of shareholders and investors. I believe that ensuring diversity among directors is valuable in realizing deeper and more careful discussions from a variety of perspectives.

Naito: To fully leverage the diversity of the Board of Directors, it is essential to have an environment where all participants can engage in open and active discussions—something our company has successfully established. Usually, the information gap between full-time directors and outside directors tends to widen. However, materials and minutes from Executive Committee and Executive General Managers Committee meetings not attended by outside directors, along with internal audit records maintained by the Corporate Business Audit Department, are regularly stored on a secure internal network with controlled access. These resources are accessible remotely, enabling outside directors to stay informed about the company’s activities. With regard to meetings of the Audit and Supervisory Committee, fulltime Director Yoshikazu Ariga provides thorough explanations of key topics discussed in internal meetings, which greatly enhances the clarity and depth of the information available to us.

For matters requiring careful deliberation, the initial presentation at the Board of Directors’ meeting typically consists of an overview and an exchange of opinions among directors. The topic is then revisited at the following meeting for more in-depth examination and formal deliberation. If a highly complex issue is both understood and resolved on the spot, it would be difficult to claim that it has been thoroughly considered. Conducting high-quality discussions is essential from a risk management perspective, and it is commendable that the company places importance on this process.

Nakada: I believe that a corporate culture in which our opinions are respected can also be said to be emblematic of the efforts that have been made to ensure the soundness and transparency of Board of Directors’ meetings. If an opinion is not aligned with the actual circumstances, President Yasuda and the other full-time directors provide a thoughtful explanation. Conversely, if the opinion is well-founded, it is promptly adopted. To give a recent example, the Securities Report for fiscal 2025 was disclosed two days before the General Meeting of Shareholders. With regard to this matter, as I had been saying that the Company should also be making preparations ever since the government at the time mentioned early disclosure of securities reports in 2024, I immediately proposed its implementation after the request came from Minister of Finance Kato in March 2025, and President Yasuda immediately made the decision, making early disclosure a reality.

Individual initiatives that led to strengthened governance

Hayashi: One of the most memorable initiatives in fiscal 2025 was the company’s efforts related to compliance. Having served as a compliance advisor for various organizations, I know that complacency—believing that everything is going well—can lead to unexpected problems, and deeper investigations often reveal lingering issues. Since joining the Board as an outside director, I have not observed any major concerns at the company. However, I remain vigilant to the possibility of underlying risks and believe that ongoing, detailed scrutiny is essential.

The Audit and Supervisory Committee conducts governance evaluations at the end of each fiscal year in accordance with the basic policy of TS TECH’s internal control system. In the draft evaluation for fiscal 2025, all items were initially assessed as having no issues. However, considering that several minor cases were observed that could potentially lead to compliance concerns, I revised the assessment to “Improvement Required,” even though the issues did not warrant public disclosure. In addition, I proposed improvements to the Company’s internal announcement procedures for disciplinary actions, as the conventional approach was deemed insufficient to deter similar incidents.

Naito: The basic policy of TS TECH’s internal control system also stipulates that the role of the Audit and Supervisory Committee is to audit subsidiaries in cooperation with the Corporate Business Audit Department. I therefore reviewed the audit content of the subsidiary from the perspective of an auditor (Audit and Supervisory Committee member) at a manufacturer where I had previously served and proposed expanding the content with regard to occupational health and safety and equipment maintenance. The sections relating to the maintaining of production are the lifeline for us as manufacturers, and we must keep a close eye on them even in subsidiaries. Another lifeline is quality control. In this regard, reports on quality are submitted to the Board of Directors every month, and the opinions of the directors fed back to operational departments as appropriate, enabling appropriate quality management to be implemented. In the case of quality issues, not only myself, coming from a manufacturing background, but also Tomoko Nakada’s comments have contributed to subsequent improvements in quality.

Nakada: During a discussion on a quality-related issue, I pointed out that there might be room for improvement in the Group’s quality management, particularly in employees’ awareness of quality and the reporting lines. Subsequently, a Group-wide initiative was launched to raise quality awareness through video content, and the department in charge sought our input during production. Rather than focusing solely on technical knowledge, I suggested incorporating relatable near-miss examples to make the message resonate more deeply with employees. I reviewed the draft, provided comments and edits, and some of my suggestions were reflected in the final video. While this may not typically be the role of a director, I believe that establishing a system in which serious issues—whether related to quality or otherwise— are properly communicated from the front lines to senior management is a vital aspect of governance. I hope that my active involvement as an outside director helped reaffirm the importance of this approach.

Future aspirations

Naito: In addition to the quality awareness activities, the department in charge and the Audit and Supervisory Committee actively exchanged opinions on the comprehensive review of the basic policy of TS TECH’s internal control system that was conducted in fiscal 2025 and were able to implement highly effective revisions. The revised policy clarifies the auditing and supervisory functions of the Audit and Supervisory Committee and enables prompt and efficient management decisions and the execution of duties. Going forward, the Audit and Supervisory Committee will work in accordance with this policy, utilizing the specialized knowledge of each committee member, and will work with executive departments to ensure the effective operation of the governance system.

Nakada: TS TECH is an excellent but little-known company that makes an impact to me as I had no idea that such a great company existed. All the Company’s employees are incredibly talented, receive excellent benefits, and are enthusiastic about their work. A conscientious company, while operating on a global basis, TS TECH remains a warm-hearted company that values the Japanese sense of obligation and human feelings. Also cooperative in providing information to us, the outside directors, the company is evolving its systems to create an environment in which it is easier for outside directors to voice their opinions. To ensure that this wonderful company continues to grow sustainably and increases its corporate value over the medium to long term, I will continue to provide frank opinions to the Board of Directors and top management from my objective perspective as an outside director. I will also strive to ensure even greater management soundness and transparency by conducting appropriate audits and supervision.

Hayashi: The need to expand the scope of information available to outside directors has been consistently identified as an issue in the annual evaluations of the Board of Directors’ effectiveness. By addressing this gap, the formulation of the 16th Medium-Term Management Plan (FY2027– 2029), scheduled for next year, is beginning to take shape in a way that reflects the diversity of perspectives among our directors.

In parallel, the Nomination and Compensation Committee, which I chair, is engaged in discussions to establish a compensation framework that encourages directors and executive officers to adopt a longer-term perspective and focus on performance. Taking into account evolving social conditions and stakeholder expectations, we are continuously exploring more appropriate system designs through study sessions and active dialogue.

Looking ahead, through the committee’s ongoing review of executive compensation and deliberations on the management structure, I remain committed to enhancing governance and driving new value creation—toward our goal of becoming “A company sincerely appreciated by all.”