Value Creation Story

2030 vision

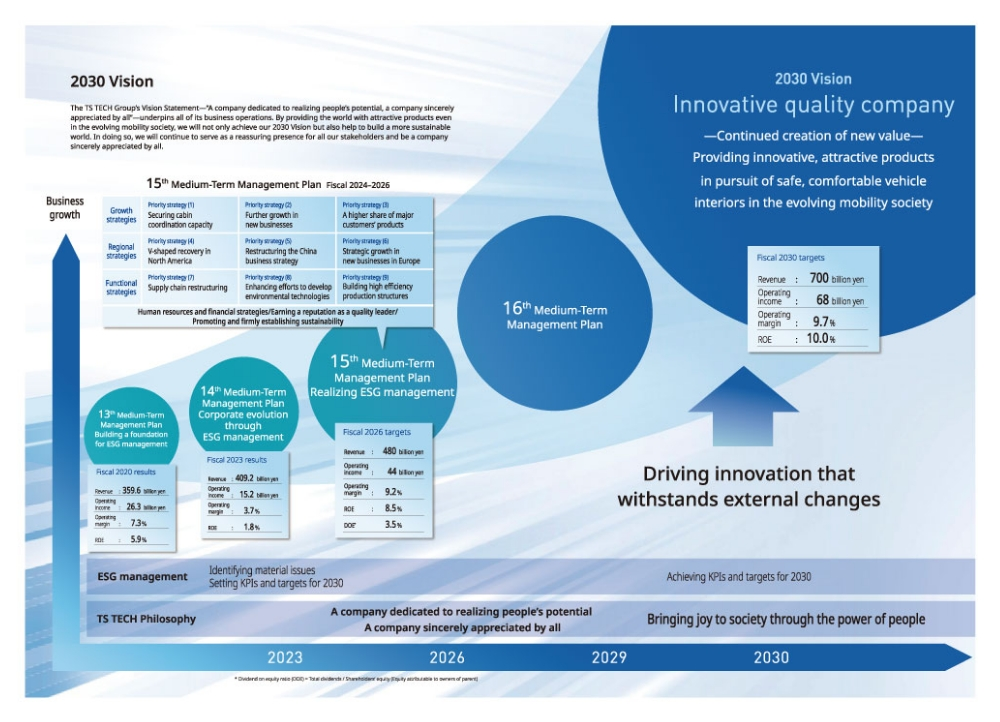

The TS TECH Group’s Vision Statement—“A company dedicated to realizing people’s potential, a company sincerely appreciated by all”—underpins all of its business operations. By providing the world with attractive products even in the evolving mobility society, we will not only achieve our 2030 Vision but also help to build a more sustainable world. In doing so, we will continue to serve as a reassuring presence for all our stakeholders and be a company sincerely appreciated by all.

Outline of the 15th Medium-Term Management PlanFiscal 2024–2026

Under the 15th Medium-Term Management Plan, we are first of all focusing on responding to the fast-changing market environment and recovering profitability as quickly as possible, in order to achieve further growth and deliver on our 2030 Vision. To do this, we will pursue nine priority strategies grouped into three areas: growth, regional, and functional. Also, seeking to bring to fruition the ESG management efforts we have implemented to date, we will aim to contribute to building a sustainable world, and we will always strive to be a reassuring presence for all our stakeholders and a company sincerely appreciated by all.

*chart can be scrolled left and right.

| Financial targets | 14th Medium-Term Management Plan results |

15th Medium-Term Management Plan targets |

2030 targets |

|---|---|---|---|

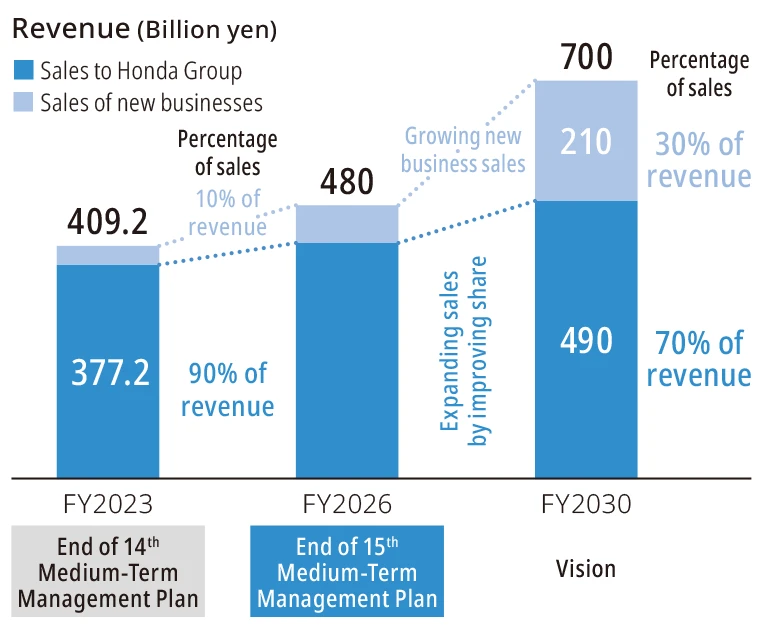

| Revenue (Billion yen) | 409.2 | 480 | 700 |

| Operating income (Billion yen) | 15.2 | 44 | 68 |

| Operating margin | 3.7% | 9.2% | 9.7% |

| ROE | 1.8% | 8.5% | 10.0% |

| Shareholder returns | |||

|---|---|---|---|

| Basic policy | Implementing sustained, stable returns unaffected by business results | ||

| Dividends | Stable increase in dividend payments, targeting DOE of 3.5% or more by the end of the 15th Medium-Term Management Plan | ||

| Acquisition of treasury stock | Flexible share buyback during the term of the 15th Medium-Term Management Plan amounting to cumulative total of approximately 20 billion yen and appropriate retirement of treasury stock | ||

| Management policy Realizing ESG management | ||

|---|---|---|

| Priority strategies | Initiatives and progress | |

| Growth strategies | 1 Securing cabin coordination capacity |

|

| 2 Further growth in new businesses |

|

|

| 3 A higher share of major customers’ products |

|

|

| Regional strategies |

4 V-shaped recovery in North America |

|

| 5 Restructuring the China business strategy |

|

|

| 6 Strategic growth in new businesses in Europe |

|

|

| Functional strategies |

7 Supply chain restructuring |

|

| 8 Enhancing efforts to develop environmental technologies |

|

|

| 9 Building high efficiency production structures |

|

|

| Foundation | Human resources strategies/ Financial strategies /Earning a reputation as a quality leader/Promoting and firmly establishing sustainability | |

|---|---|---|

The TS TECH Group has achieved steady business growth as a global partner of the Honda Group. In order to achieve further growth, we will strive to realize our 2030 Vision not only by executing the strategy of earning “a higher share of major customers’ products” with a focus on the Honda Group, but also with the strategy of “further growth in new businesses,” for instance expanding commercial rights from new customers.

As for new business areas, although we face delays in some order plans due to customers revising their own development plans in response to demand fluctuations in the EV market, we have been successful in acquiring new commercial rights from the Suzuki Group. In addition, we have received a new order for commercial rights for parts from a local Chinese automaker, and we will further accelerate our sales activities to achieve our goals.

We promote thorough automation of production and inspection processes to build high efficiency production structures that outperform the competition. We will further accelerate the development of manufacturing technology by advancing the construction of a new Production Technology Building at the Saitama Plant that will enable verification and validation of manufacturing technology and mass production, establishing Japan as home of a “global mother plant,” and disseminating the manufacturing technology generated there to the Group’s production sites.

At the same time, the reorganization of domestic and overseas production sites, which we have been steadily carrying out to further strengthen the competitiveness of components and improve profitability, is progressing according to plan.

- Strengthening global mother plant functions through production reorganization at the Saitama Plant

- Streamlining processes through integration of domestic subsidiaries

- Commencing the manufacturing of molds and the operation of a technology development facility

- Sharing expertise through exchange of mold production technology with H-ONE CO., LTD.

- Consolidating production sites in Indonesia

Generating Value in Four Regional Segments

The TS TECH Group organizes its business operations into four regional “segments”: Japan, China, the Americas, and the rest of Asia plus Europe. We are committed to achieving business growth by diversifying our customer base and pursuing efficiency improvements and cost reductions from a number of angles.

| Japan | The Americas | China | Asia and Europe | |

|---|---|---|---|---|

| Number of affiliates | 7 | 16 | 8 | 12 |

| Number of employees (People) | 2,294 | 8,166 | 2,344 | 1,915 |

| Motorcycle business revenue (Million yen) | 4,637 | 304 | — | 3,151 |

| Automobile business revenue (Million yen)* | 51,557 | 230,891 | 85,254 | 43,509 |

| (Seats) | 48,436 | 204,395 | 82,606 | 39,454 |

| (Interior products) | 3,121 | 26,495 | 2,647 | 4,054 |

| Revenue from other businesses (Million yen)* | 14,144 | 8,186 | — | 76 |

| Total (Million yen)* | 70,340 | 239,381 | 85,254 | 46,737 |

| Capital expenditures (Million yen) | 6,370 | 5,082 | 667 | 1,443 |

- Inter-segment transactions are eliminated by offsetting and only revenue from sales to external customers is presented.

We are working on the reorganization of the Saitama district to build high efficiency production structures, with the aim of further advancing manufacturing technologies and enhancing the income structure. By constructing a new Production Technology Building at the Saitama Plant that will enable verification and validation of manufacturing technology and mass production, we aim to enhance technology development in the production domain. We will then disseminate the manufacturing technology generated there to the Group’s production sites, further enhancing the functions of the Saitama Plant as a global mother facility.

In the Americas, while the size of the market has allowed the segment to generate the highest revenue in the Group, profitability remains a challenge due to a number of factors, including high labor and material costs. We aim to achieve a V-shaped recovery to a highly profitable structure that is resilient to changes in the environment by investing in efforts to improve the production structure. We will, for instance, introduce equipment to automate the production process and launch an automated vertical warehouse system that can respond flexibly to fluctuations in production.

In China, we are facing an unprecedented uphill battle due to the growing power of emerging EV manufacturers. In order to support the profitability of the TS TECH Group, we are engaged in efforts to acquire new customers and new commercial rights by establishing partnerships with new companies, seeking to gain a competitive edge in the increasingly crowded Chinese market. In addition, we are working to improve the income structure by pursuing production automation, optimizing staffing levels, and utilizing local manufacturers.

In response to the growth in orders for Maruti Suzuki India Limited, we are working to strengthen our production system in India. We will build a new plant on the site of the Indian plant of Imasen Electric Industrial Co., Ltd.* to expand production capacity. At the same time, we will make effective use of the space made available at the existing plant and strengthen our cost-competitiveness. In addition, our production site in Poland, which is now fully operational, will aim to grow sales further by taking advantage of its location to supply competitively priced products to European customers.

- The TS TECH Group entered into a capital and business alliance with Imasen Electric Industrial Co., Ltd. in November 2020 with the aim of expanding sales channels and commercial rights, strengthening technology and research and development, and improving cost-competitiveness.