Board of Directors’ Dialogue

Evolution and Challenges Arising from Governance Reforms

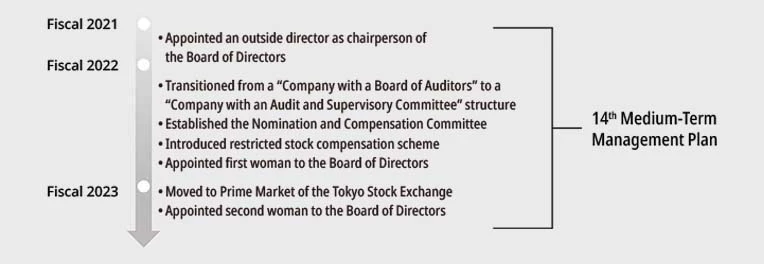

The TS TECH Group’s stated management policy is “corporate evolution through ESG management.” Accordingly, we are moving forward with governance reforms from various perspectives, including organizational layout and diversification of the Board of Directors. We invited three members of the board to discuss the outcomes and challenges that have arisen as we implement new systems and structural changes relating to corporate governance in recent years, and their aspirations for the future.

Recent governance reform

Representative Director, Vice President

Yoshitaka Nakajima

- Apr. 1982

- Joined the Company

- Apr. 2004

- Corporate Administration Division, Administration Department General Manager

- Apr. 2010

- Operating Officer, Corporate Administration Division Deputy Executive General Manager

- Apr. 2012

- Operating Officer, Corporate Administration Division Executive General Manager

- June 2012

- Director, Corporate Administration Division Executive General Manager, Compliance Officer (current)

- Apr. 2015

- Director, Corporate Administration Division Executive General Manager, Corporate

Business Administration Division Executive General Manager

- June 2015

- Managing Director, Corporate Administration Division Executive General Manager,

Corporate Business Administration Division Executive General Manager

- Apr. 2016

- Managing Director, Corporate Administration Division Executive General Manager

- June 2018

- Senior Managing Director, Corporate Administration Division Executive General Manager

- June 2020

- Senior Managing Director (Representative Director)

- Apr. 2022

- Representative Director, Vice President (current)

Director, Audit and Supervisory Committee Member

(Outside Director, Chairperson of the Nomination and Compensation Committee)

Tatsuya Motoda

- May 1993

- Joined Anderson Consulting (now Accenture Japan Ltd.)

- Sept. 1999

- Joined Tsuji CPA Accounting Office (now Hongo Tsuji Taxing & Consulting)

- Apr. 2007

- International Tax Affairs Department General Manager, Tsuji CPA Accounting Office

- Oct. 2008

- Registered as a tax accountant

- Apr. 2014

- Representative tax accountant, Motoda Tax & Accounting Office (current)

- June 2014

- Auditor, TS TECH

- July 2018

- Outside Auditor, Global Information, Inc.

- June 2021

- Director, TS TECH (Audit and Supervisory Committee Member) (current)

- Mar. 2022

- Outside Director, Global Information, Inc. (Audit and Supervisory Committee Member) (current)

- Apr. 2022

- Outside Director, Mitsui High-tec, Inc. (Audit and Supervisory Committee Member) (current)

Director

(Outside Director, Chairperson of the Board of Directors)

Takeshi Ogita

- Apr. 1980

- Joined Sankyo Co., Ltd.

- July 2004

- Corporate Officer, Head of New Drug Development Division, Sankyo Co., Ltd.

- Apr. 2007

- Executive Officer, Head of Pharmaceutical Technology Division, Daiichi Sankyo Co., Ltd.

- June 2009

- Member of the Board, Senior Executive Officer, Daiichi Sankyo Co., Ltd.

- Apr. 2014

- Member of the Board, Senior Executive Officer, Head of Vaccine Business Intelligence Division, Daiichi Sankyo Co., Ltd.

- Apr. 2017

- Guest Professor, Graduate School of Creative Science and Engineering, Waseda University

- June 2018

- Outside Director, Japan Hades Co., Ltd. (current)

- June 2020

- Director, TS TECH (current)

- June 2022

- Chairperson of the Board of Directors, TS TECH (current)

Aims of Corporate Governance Reforms

- Nakajima:

The key to corporate governance is to formulate, manage, and operate internal mechanisms and systems to ensure that people and organizations do not contravene laws and regulations. Such systems would be meaningless if we implemented them in name only, so we must ensure their effectiveness, treating them as initiatives that protect shareholder returns and drive responsible, stakeholder-oriented actions.

In addition, making our corporate governance systems more advanced also serves to promote appropriate risktaking in management. By so doing, we aim to enhance corporate value by creating a self-sustaining cycle of investment in growth, increased competitiveness, and improved profitability across the Group. We are working to build structures that will support the autonomous growth and evolution of the company. In doing so, we are reviewing past customs and practices and engaging proactively in good practices or new initiatives. This is how we are pursuing reforms with a clear vision for where we want to take the company

- Motoda:

-

Yes, I believe that our corporate governance structures are indeed steadily evolving. In terms of organizational layout, by moving to become a “Company with an Audit and Supervisory Committee” as of fiscal 2022, we have ensured even more highly objective organizational auditing. Also, with that shift, the Audit and Supervisory Committee now directly supervises the internal audit department, meaning that closer cooperation than ever before is now possible. This enables us to provide detailed responses in cooperation with the internal audit department, on matters ranging from sudden or unexpected tasks such as additional audits of specific departments or Group companies, to regular tasks such as checking the information security measures put in place by the systems department.

In recent years, although we have faced the challenge of not being able to conduct face-to-face audits due to COVID-19-related constraints, swiftly constructing a remote auditing structure made it possible to conduct organizational audits more efficiently. Whether in or outside Japan, by leveraging the internet to put in place a rapid information disclosure system, we have significantly boosted auditing efficiency.

- Ogita:

-

My feeling is that governance reforms have strengthened the separation of supervision and execution. Since June 2020, the chairperson of the Board of Directors has been an outside director, and since June 2022, I have been serving in that position. I believe that this initiative is extremely beneficial and is the right direction for the Board of Directors, as an organization that specializes in the supervision of management, rather than merely the execution of business operations. The fact that the proportion of outside directors has increased is another development that serves to advance the separation of supervision and execution. I fully concur that this demonstrates an openness to incorporating objective opinions from outside the company.

The statements made by outside directors in board meetings are extremely valuable. That being said, the internal directors are the ones who, depending on the situation, may have detailed knowledge of the agenda prior to the board meeting, through participation in internal meetings, or discussions with relevant parties. It is no simple matter to present opinions that are objective and contribute to better decision-making because they know the actual situation. On the other hand, it is precisely because outside directors possess only a certain amount of information with regard to agenda items that they can make unexpected observations, or pose questions that capture the essential nature of an issue. Accordingly, these opinions can inspire the board as a whole to arrive at solutions that internal directors alone could not achieve. I have had experience working as an outside director at other companies, and I feel that there is really meaningful and vigorous debate among the internal and external members of the Board of Directors of TS TECH.

Aiming for Greater Transparency in the Nomination and Compensation System

- Motoda:

-

One of the important challenges relating to transparency of corporate governance systems is the decisionmaking processes for nomination and compensation of corporate officers. I head the Nomination and Compensation Committee, which is a voluntary advisory body to the Board of Directors and works to improve the transparency, objectivity, and fairness of various processes by taking responsibility for the selection, dismissal, and compensation of directors and corporate officers. When making nominations, in addition to confirming the career record of each candidate, we also assess their various personal traits by speaking with various related parties, deliberating whether they match the criteria to become a director or corporate officer of the company. With regard to compensation, the committee also deliberates the appropriateness of remuneration and directors’ bonuses, which are determined by a compensation table based on position and individual performance, as well as performance-linked compensation, and we report the results to the Audit and Supervisory Committee and also report information on the subject to the Board of Directors.

- Nakajima:

-

Officer compensation for TS TECH consists of basic fixed compensation, performance-linked remuneration as a short-term incentive, and non-monetary stock-based compensation. With regard to stock-based compensation, a restricted stock compensation scheme has been in place since 2021 for directors (excluding outside directors and directors who are members of the Audit and Supervisory Committee) and executive officers who do not concurrently serve as directors. The purpose of the system is to further share value with shareholders, and at the same time, by setting incentives for officers, to enhance global competitiveness through management practices that are conscious of medium- to long-term corporate value enhancement from an investor perspective. We are now in the second year since the scheme’s implementation and, in that time, discussions in board meetings and in various other forums have dramatically increased from the perspective of market perceptions of the company, and whether initiatives will lead to mediumto long-term corporate growth. We will continue to review executive compensation as appropriate, given that it is an important means of achieving proactive governance designed to maximize corporate value.

Effectiveness of the Board of Directors and Challenges for Governance Systems

- Nakajima:

-

Currently TS TECH complies with all principles detailed in Japan’s Corporate Governance Code (CG Code). However, no matter how well formulated the CG Code may be, it is meaningless unless the Board of Directors and other organizations function in accordance with its essential aspects. In order to enhance the effectiveness of the Board of Directors, it is essential that our outside directors are encouraged to actively make recommendations from a third-party perspective. In that sense, through changes to the organizational layout, it is of tremendous significance that the ratio of outside directors has increased. Furthermore, in fiscal 2022 we appointed our first woman as director, and now two women are members of the board. We hope to further enhance the board’s effectiveness by improving its diversity and hearing opinions from various perspectives.

We implement an annual assessment of the effectiveness of the Board of Directors. Already this assessment has been conducted on four occasions, receiving a relatively high evaluation from all board members, but my own perception is that there is still leeway for us to improve further. For example, take more active debate. It is of critical importance for the Board of Directors to engage in vigorous discussions, not only for the purpose of passing resolutions and making decisions but also for each member to share his or her own opinions and unique perspectives on how the Group should aim to grow. In particular, I believe that giving the younger board members who represent the future of the company the freedom to say what they want will breathe new life into the board and set the foundations for tomorrow for the entire TS TECH Group. Without pandering to position or experience, I believe that it is my role to create a culture and forum where people can air their views freely and forthrightly.

It is necessary to change the way we operate the Board of Directors according to the vision of the TS TECH Group. We must not simply fall into complacency, but instead constantly seek out and evolve toward our vision.

- Ogita:

-

Two years have now passed since I was appointed. In that time, I have strongly felt the determination to evolve, as seen in the ambitious strengthening of the corporate governance system. Thanks to these efforts, the format for organizational layout and other structural aspects has been completed. My belief is that the next step is now to further enhance the effectiveness of the content. The automobile industry is in the midst of a period of transformation, buffeted by new trends such as CASE and MaaS. The global situation remains unstable and uncertain, and therefore, in order to overcome this environment of dizzying change and achieve active and continued growth for the TS TECH Group, we must engage in multifaceted discussions, taking advantage of the diversity inherent in the board, including each member’s various skills, experiences, and gender perspectives.

- Motoda:

-

I too think that it is extremely important for the Group’s future that we harness our diversity. As you note, we are making steady progress with initiatives to improve the diversity of the board, including raising the percentage of outside directors and appointing women as directors. However, in light of the standards required in Europe and the United States, as well as the diversity concepts found in the CG Code, we may be required to ensure that more than one-third of total board membership is comprised of women in the future. In such an event, while it is relatively simple to invite people to become outside directors, our goal must be to create a future in which professional women in our workforce, nurtured by the company’s own succession plan, will take leading roles in the company. Given that the proportion of women working at manufacturing companies in Japan such as ours is low, we must overcome the difficulties we face to ensure greater empowerment of women.

Growth Strategy and Corporate Governance

- Nakajima:

-

It is also necessary for the Board of Directors to further improve its effectiveness in the future as a forum for discussing growth strategy.

We are currently engaging in discussions to formulate the 15th Medium-Term Management Plan, which will start in fiscal 2024, but using an approach that differs from what we have done previously. For previous plans, we identified the management issues at that specific point in time and formulated priority policies and specific initiatives in order to resolve these issues. For the upcoming plan, while ensuring that immediate and pressing management issues are definitely dealt with, we also aim to clarify where we would like the Group to be in five to ten years’ time and devise a plan that focuses on the kinds of strategies we will employ to achieve growth in order to realize that future vision. We will also establish quantitative KPIs that will act as milestones along the road to our future vision, delegate authority firmly to the executive side, and, under a Board of Directors equipped with enhanced supervisory functions, execute our plans dynamically to realize our goals.

- Ogita:

-

I also believe that the board must play a larger role in formulating the Group’s growth strategy and Medium-Term Management Plan. For the company to achieve sustainable growth in a period of historic transformation, it is vital that we devise strategies that take in the big picture from diverse perspectives. The board, comprised of diverse members, each with their own high levels of expertise and insight, is expected to make a significant contribution. I also think that it is important to provide forums where every board member can relax and freely discuss the big picture, outside the confines of formal board meeting discussions. I would like to create such opportunities going forward.

- Motoda:

-

When you consider the prerequisites for a board that supports growth strategy, members must be possessed of adequate experience and competence. However, we face challenges in terms of the development of our successors, who will lead the company to the next generation. In my capacity as head of the Nomination and Compensation Committee, I intend to make recommendations about how to further improve the level of formulation, operation, and monitoring of development plans. These improvements, in turn, will help to enhance fairness and transparency and construct a system that will drive improvement of corporate value in the medium to long term.

Aspirations for the Future

- Ogita:

-

As chairperson of the Board of Directors, my constant task is to invigorate discussions among members. By learning about and gaining a deeper understanding of the management situation of the TS TECH Group, I aim to be a chairperson capable of detecting potential issues and guiding board proceedings with a view to resolving such issues. Also, as an outside director, by stating opinions and making recommendations based on my own experiences, I hope to contribute actively to the formulation of the next Medium- Term Management Plan and guide the further growth of the TS TECH Group.

- Motoda:

-

As head of the Nomination and Compensation Committee, I will continue to strive to carefully deliberate the background, expertise, and personal qualities of candidates for director and corporate officer positions. By operating the committee in a highly transparent and objective manner, I will contribute to the construction of a corporate governance structure that supports sustainable growth.

- Nakajima:

-

My position as vice president also requires me to support the president, and there are times when I must inevitably say “no.” Always putting the Group’s growth first, I am committed to continuing to take a free and just approach to all matters to ensure that top management can make appropriate business decisions.

To ensure that the TS TECH Group can journey confidently into the future, we must continue to improve the effectiveness of the Board of Directors by delegating authority and passing on positions from current members to the next generation of management members, and by working to overcome the various challenges we face. Going forward, both the outside and internal members of the board will combine their efforts to further advance corporate governance at the TS TECH Group.