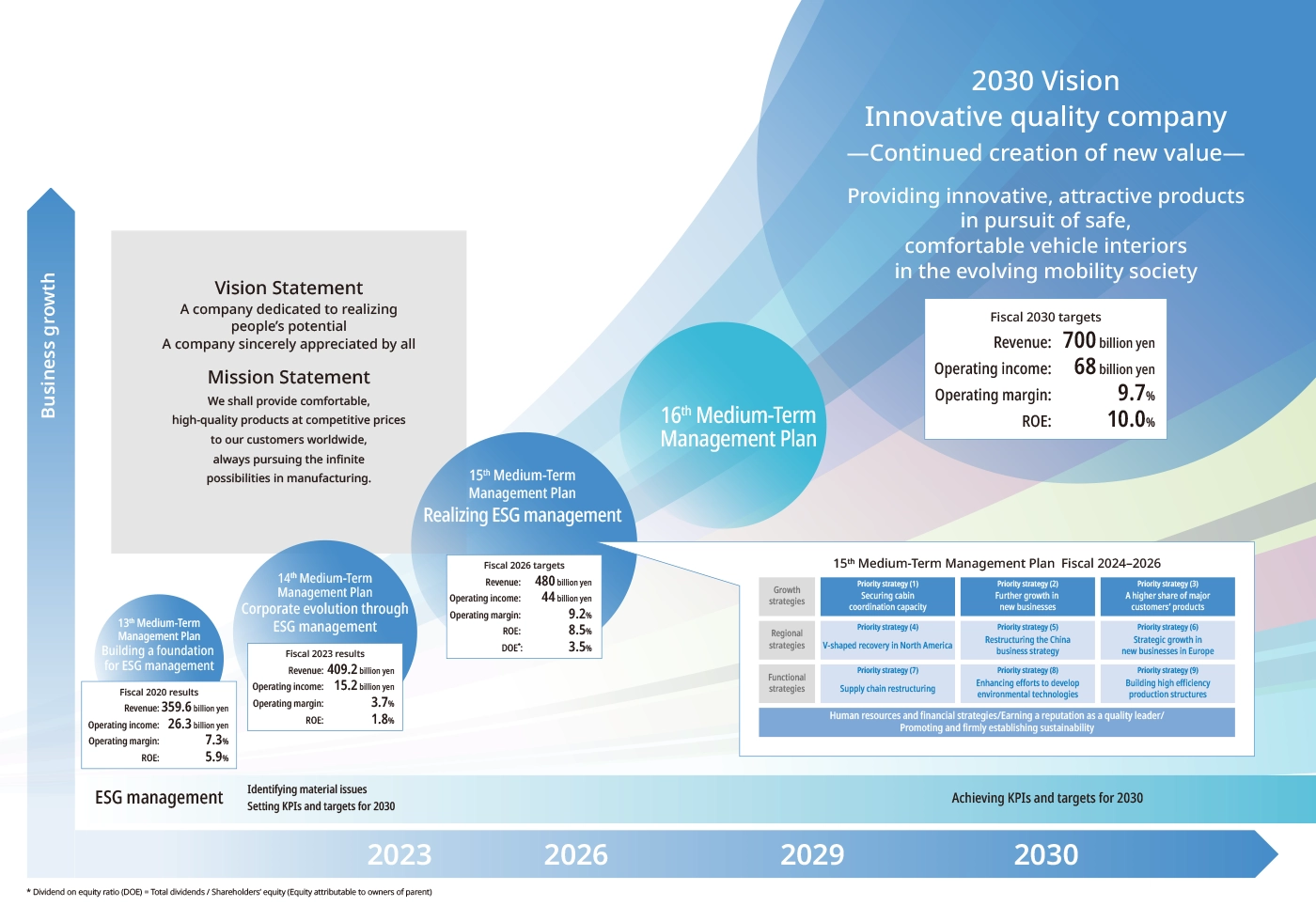

Medium-Term Management Plan

2030 Vision

Financial targets

*chart can be scrolled left and right.

| 14th Medium-Term Management Plan results |

15th Medium-Term Management Plan targets |

2030 targets | |

|---|---|---|---|

| Revenue (Billion yen) | 409.2 | 480 | 700 |

| Operating income (Billion yen) | 15.2 | 44 | 68 |

| Operating margin | 3.7% | 9.2% | 9.7% |

| ROE | 1.8% | 8.5% | 10.0% |

Shareholder returns

TS TECH has regarded shareholder returns as a key management issue.

We have established following shareholder return policy in order to achieve a PBR above 1 as soon as possible, based on sustained growth achieved through growth investments and enhanced shareholder returns.

*chart can be scrolled left and right.

| Basic policy | Implementing sustained, stable returns unaffected by business results |

|---|---|

| Dividends | Stable increase in dividend payments, targeting DOE* of 3.5% or more by the end of the 15th Medium-Term Management Plan |

| Acquisition of treasury stock | Flexible share buyback during the term of the 15th Medium-Term Management Plan amounting to cumulative total of 20 billion yen and appropriate retirement of treasury stock |

- Dividend on equity ratio (DOE) = Total dividends / Shareholders’ equity (Equity attributable to owners of parent)

Materiality KPIs

The TS TECH Group has established sustainability targets for 2030 with indices indicating the vision the Group aims to achieve for itself by that year

*chart can be scrolled left and right.

| 14th Medium-Term Management Plan results |

15th Medium-Term Management Plan targets |

2030 targets | ||

|---|---|---|---|---|

|

Society |

Innovative technology development expenses as a percentage of R&D expenses |

vs. FY2021 +2.6% |

vs. FY2021 +3% |

vs. FY2021 +10% |

| Seat supplier IQS rating | 8.8P | 7.0P | 2.0P (stable high levels) |

|

|

Environment |

CO₂ emissions reduction rate |

vs. FY2021 -16% |

vs. FY2021 -25% |

vs. FY2021 -50% |

| Waste reduction rate | vs. FY2021 -16%(Total) |

vs. FY2021 -25% |

vs. FY2021 -50% |

|

| Water intake reduction rate and environmental impact from wastewater |

vs. FY2021 -13% (Total) |

vs. FY2021 -15% |

vs. FY2021 -50% “0” environmental impact |

|

| Establishment of the TS TECH Fund (matching gift program) |

Program survey Study of plans |

Establishing a TS TECH Group donation program |

Establishing a TS TECH Group donation program |

|

|

Corporate |

Engagement rating | C | BB | AAA |

| Supplier Sustainability Guidelines compliance rate |

97% (Subject: 126 domestic suppliers) |

100% (Subject: Domestic and international suppliers) |

100% (Subject: Domestic and international suppliers) |

|

| Percentage of management positions held by diverse human resources |

32.5% | 33.3% | 35% | |

| Corporate Governance Code compliance rate |

100% | 100% | 100% | |

15th Medium-Term Management Plan

targets FY2024–2026

Priority strategies

To achieve further growth and deliver on our 2030 Vision, we set out nine key strategies, comprising growth, regional and functional strategies. We also aim to help to build a sustainable world, as the ESG management initiatives we have been implementing since the 13th Medium-Term Management Plan culminate, and always seek to be a reassuring presence for our stakeholders and “A company sincerely appreciated by all.

Management Policy

Realizing ESG management

Growth

strategies

Priority strategy (1)

Securing cabin

coordination capacity

Priority strategy (2)

Further growth in

new businesses

Priority strategy (3)

A higher share of major

customers’ products

Regional

strategies

Priority strategy (4)

V-shaped recovery in North America

Priority strategy (5)

Restructuring the China

business strategy

Priority strategy (6)

Strategic growth in

new businesses in Europe

Functional

strategies

Priority strategy (7)

Supply chain restructuring

Priority strategy (8)

Enhancing efforts to develop

environmental technologies

Priority strategy (9)

Building high efficiency

production structures

Human resources and financial strategies/Earning a reputation

as a quality leader/Promoting and firmly establishing sustainability

Growth strategies

Priority strategy (1) Securing cabin coordination capacity

As business models in the auto industry change at breathtaking speed with the progress of EVs and self-driving technologies and other developments, changes in the business environment are accelerating. Seeing these as business opportunities, we will accelerate the transformation to a company able to propose new value to customers and users, through coordinating the cabin interior as a whole, in order to realize further business growth.

Creating attractive cabin products and technologies

- Proactive cocreation activities alongside other divisions

- Enhancing basic research on ergonomics and other fields

Enhancing systems and software development capabilities

- Embedding seat integrated ECUs

- Training advanced engineers

Targeting the swift adoption of new technologies in mass-produced vehicles

through advanced development procedures

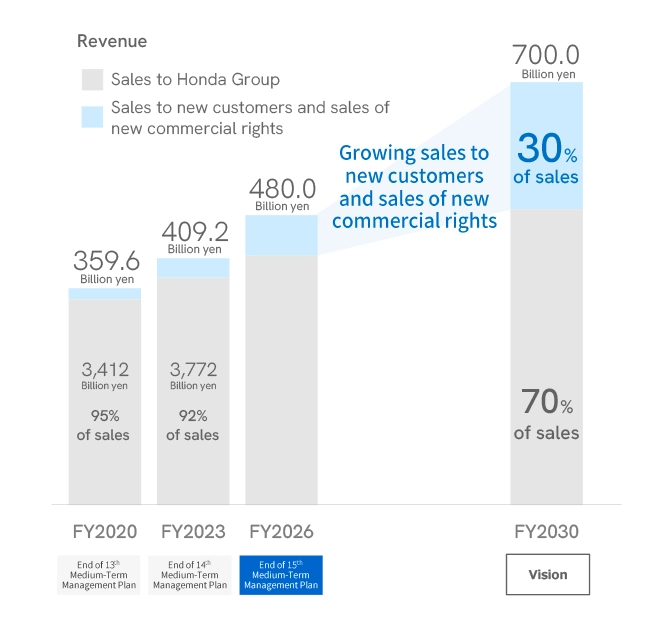

Priority strategy (2) Further growth in new businesses

Under the leadership of the New Business Management Division, established to secure customers outside the Honda Group, we will deploy strategic sales activities targeting customers around the world. We will grow sales further through development and sales activities based on understanding customers' individual needs.

Strategic acceptance of orders for target commercial rights

- Securing commercial rights for derivative models that incorporate technologies from existing ordered models

- Securing orders for advance development on future models by proposing nextgeneration technologies in advance

New customer development

- Enhancing joint efforts between individual regions and the head office, centered on the New Business Coordination Division

Aiming for about 30% of revenue from sales to

new customers and sales

of new commercial rights in 2030

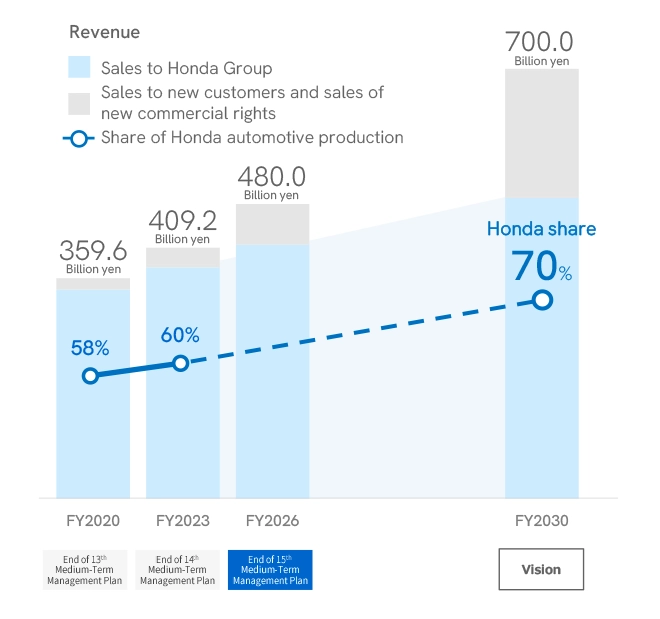

Priority strategy (3) A higher share of major customers’ products

We will strive to grow our share of Honda's automobile seats as we aim for further business growth as a Honda Group global partner.

We will aim for further share growth by increasing customer satisfaction through creating attractive products, cocreation of products with customers from the initial development stage, cooperation among regional and functional divisions, and activities to secure orders based on regional characteristics.

Receiving orders for seat trading rights through regional coordination

- Securing commercial rights in regions where we receive orders for seat trading rights

- Building new partnerships and deploying sales activities utilizing them

Growing ordered received for parts commercial rights

- Steadily receiving orders for shared frames

- Enhancing development to receive orders for light-vehicle frames

- Growing ordered received through enhanccing our competitive strengths in parts

Toward a share of 70% of automotive seats

for Honda through steadily securing commercial rights

Regional strategies

Priority strategy (4) V-shaped recovery in North America

In the Americas, while the region contributes to Group revenues due to its considerable market size profitability is decreasing for various reasons, including rising labor costs and production losses due to receipt of variable production orders and skyrocketing raw-material prices. We will carry out structural reforms to effect a V-shaped recovery in revenues by overcoming these challenges.

Thorough automation of production line to keep up with irregular production and cost increase pressures

Toward a share of 70% of automotive seats

for Honda through steadily

securing commercial rights

Priority strategy (5) Restructuring the China business strategy

Restructuring the China business strategy

Building new partnerships aiming to secure new customers

Expanding use of local manufacturers to lower costs and reduce procurement risks

Building new business structures not bound by existing businesses

Priority strategy (6) Strategic growth in new businesses in Europe

The newly established production facility in Poland is able, thanks to its location, to supply price-competitive products to European automakers in Germany, the Czech Republic, Slovakia, and elsewhere. We will aim to leverage our competitive strengths in components for further growth in our businesses serving European automakers.

Sales development with Poland as a key station

New establishment of a trim cover production company with a view to expanding adoption of components

Further business expansion with European automakers

Functional strategies

Priority strategy (7) Supply chain restructuring

To stabilize the components supply structure, in addition to more stable procurement through visualization of product flows and high-risk component s we will aim to build profitable and sustainable supply chains through means including slimming down increasingly complex processes and adopting local procurement to cut costs while also reducing CO2 emissions in partnership with suppliers.

Balancing stability and profitability through risk visualization and efforts to promote local procurement Working with business partners to reduce supply chain CO₂ emissions volume (Scope 3)

Building a sustainable supply chain

Priority strategy (8) Enhancing efforts to develop environmental technologies

Environmental technologies to lessen environmental impacts will be vital to future business growth. We will develop technologies for switching to sustainable materials* in addition to the weight-saving technologies we have long promoted.

- Raw materials with lower life-cycle environmental impacts, sourced from renewable resources

Establishment of technologies for product applications for biomass materials and eco-friendly steel materials

Resource recycling accomplished by selecting materials and designing structures with recycling in mind

Realizing swift product development using environmental technologies

Priority strategy (9) Building high efficiency production structures

We will improve labor productivity through further evolution of production lines, including thorough automation and enhancement of in-process verification using digital technologies. We also will make progress on cutting electricity use and adoption of production technologies to lessen environmental impacts, as sustainability initiatives.

Continued evolution of production linesbased on thorough automation and adoption of AI technologies

Realization of sustainable manufacturing through the use of energy-saving technologies

Building production structures superior to the competition

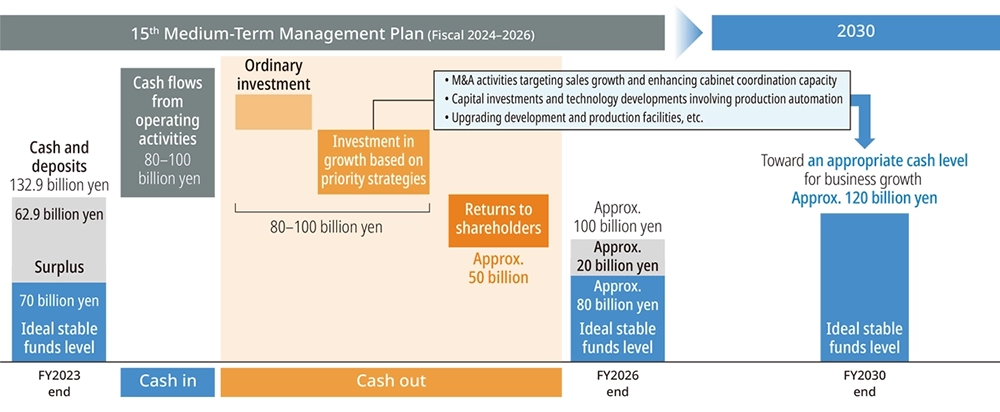

Financial Strategies

Capital structure goals

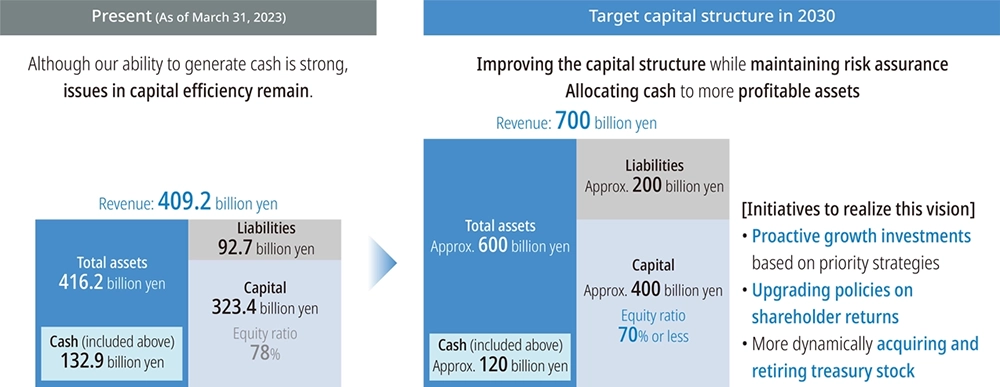

The TS TECH Group has built a profit structure that can steadily generate cash even under challenging business environments such as the global financial crisis, the Great East Japan Earthquake, and the recent COVID-19 pandemic. As a result, as of March 31, 2023, the Group as a whole held 132.9 billion yen in cash with a consolidated equity ratio of 78%, securing a very high level of financial security. However, in order to achieve the 2030 Vision and ensure we remain a company sincerely appreciated by all, we must utilize capital more efficiently than ever before and accelerate the speed of growth.

Cash generation and use

Although The TS TECH Group has a solid financial base, it recognizes that there are challenges in making effective use of accumulated capital. To improve the capital composition and allocate cash flow to more profitable assets while maintaining financial stability, we will invest actively in growth based on priority strategies.