Financial Strategies

Overview of the first year of the 15th Medium-Term Management Plan

I am Hiroshi Naito, and starting in fiscal 2025, I have been appointed Executive General Manager of the Corporate Business Administration Division, which is in charge of finance and accounting. Finance plays an important role in supporting the healthy operation and growth of a company, and I feel a great sense of responsibility. I will make the most of my experience to contribute to the sustainable growth of the Group by tackling a variety of issues. These range from formulating and implementing appropriate financial strategies to strengthening risk management.

The automotive industry is in the midst of a great upheaval, the business environment in which the Group operates is changing rapidly, and the future is more uncertain than ever. Companies today need to respond to proliferating challenges, including heightened geopolitical risks such as those related to Russia’s prolonged invasion of Ukraine, high energy and raw materials prices, and rising labor costs. Against this backdrop, our 15th Medium-Term Management Plan (fiscal 2024–2026) defines our management policy as “realizing ESG management,” and sets out nine priority strategies.

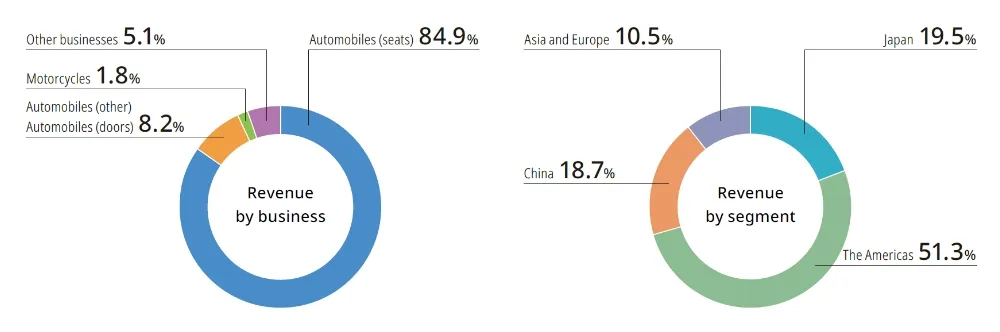

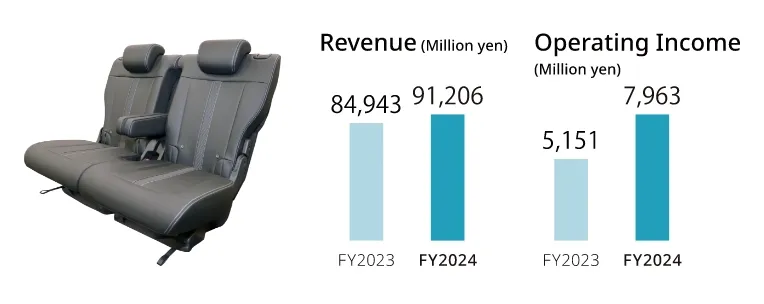

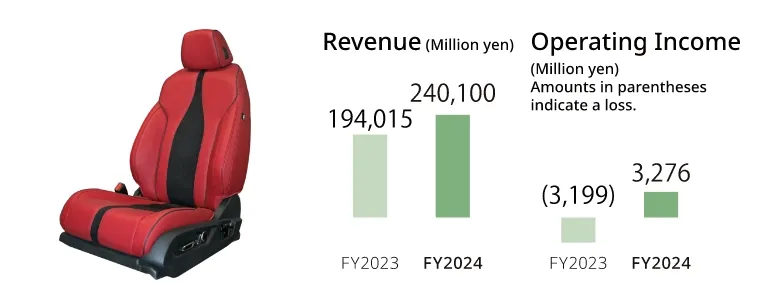

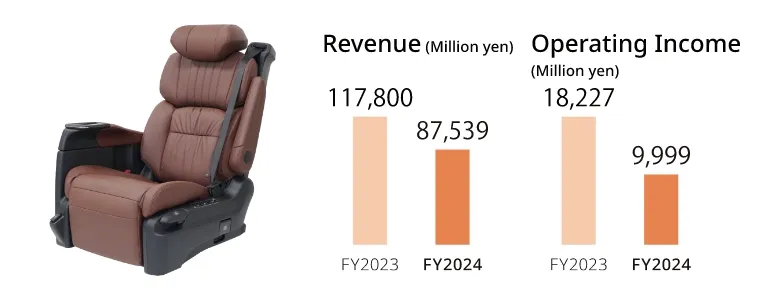

The consolidated results for fiscal 2024 (the first year of our 15th Medium-Term Management Plan) were revenue of 441.7 billion yen (up 32.5 billion yen year on year) and operating income of 17.5 billion yen (up 2.2 billion yen year on year). This was due to higher production resulted from the recovery of customer production, mainly in the Americas, following the resolution of the semiconductor supply shortage, and to the effects of foreign exchange rates due to the depreciation of the yen. Moreover, we have been working to improve profitability in the Americas segment—which boasts the Group’s largest revenue, due to the size of the market—under the banner of a V-shaped recovery in North America. We achieved increased revenue of 240.1 billion yen (up 46.0 billion yen year on year) and operating income of 3.2 billion yen (up 6.4 billion yen year on year). Although we have faced increases in raw material and labor costs due to changes in the external environment, we have been able to move forward steadily with preparations for building a profitable structure that can withstand changes in the environment. These include improving quality and production efficiency by introducing new laser welding equipment and improving our responsiveness to line stoppages and fluctuations in production by introducing an automated vertical warehouse facility. Meanwhile, in the China segment, we are restructuring the China business strategy. However, sluggish sales to customers who face intensified competition led revenue to decline to 87.5 billion yen (down 30.2 billion yen year on year) and operating income to decline to 9.9 billion yen (down 8.2 billion yen year on year). Although we expect the business environment to remain challenging, we will rebuild our business foundation to survive in the increasingly competitive Chinese market by optimizing manufacturing and back-office staffing, using local manufacturers to reduce costs, and accelerating sales activities to acquire commercial rights to seats for local automakers.

In fiscal 2025, the second year of our 15th Medium-Term Management Plan, we expect increased production in the Japan and Americas segments, leading to sales revenue of 450 billion yen (up 8.2 billion yen year on year) and operating income of 20.0 billion yen (up 2.4 billion yen year on year). Despite the drastically changing market environment, we will leverage our solid financial foundation to support business growth and move forward with many preparatory measures for growing sales and strengthening our earnings structure.

Strategically allocating resources for sustainable growth

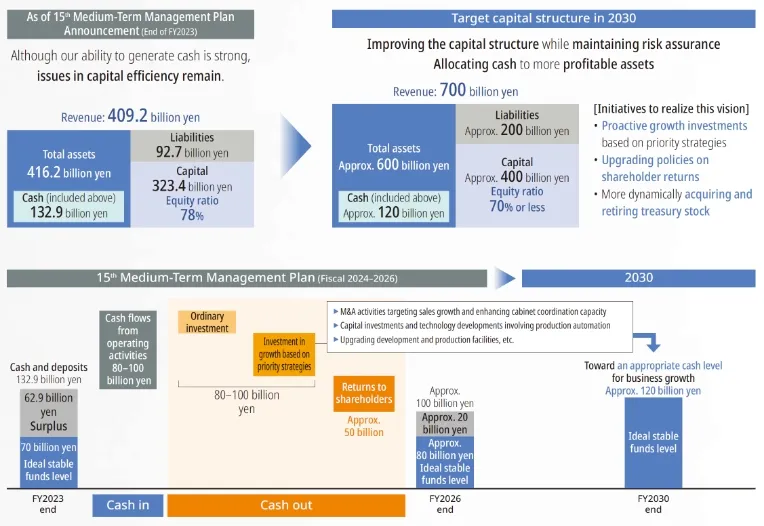

The TS TECH Group has steadily enhanced its profitability despite the challenging business environment. As a result, even as the external environment has worsened, with supply chain disruptions since the pandemic, decreases in automaker production volumes due to semiconductor supply shortages, and soaring energy and raw material costs, we have generated a cumulative total of 157.4 billion yen in operating cash flow during the five-year period between fiscal 2020 and fiscal 2024. In addition, as of March 31, 2024, our consolidated capital adequacy, excluding non-controlling interests, was 73.3%, an extremely high figure. Consequently, we have secured a level of on-hand liquidity that enables us to use our own funds to support growth investments and M&A. However, we recognize that there are challenges from the perspective of capital efficiency. In this period of immense change, we need to utilize capital more efficiently than ever before and accelerate our rate of growth to achieve our 2030 Vision and remain a company sincerely appreciated by all stakeholders.

To achieve our 2030 Vision, we will allocate cash to more profitable assets, while improving our capital structure and maintaining safety. We will set an appropriate cash level of 120 billion yen, assuming revenue of 700 billion yen in 2030, then strategically allocate funds in excess of that level to growth investments and shareholder returns in order to enhance our corporate value.

We will allocate a total of 80–100 billion yen during our 15th Medium-Term Management Plan to growth investments to drive future business expansion. In addition to the investments needed for normal business operations, we specifically plan to expand our new businesses, including increasing orders from Maruti Suzuki India Limited, to secure cabin coordination capacity focused on developing next-generation technologies such as extended slide seat rails, to introduce and deploy production automation equipment and automated vertical warehouse facilities, and to renovate our development and production sites. We aim to boost profits through further business growth and improved profitability by strategically utilizing the cash generated. In addition, we will streamline shareholder equity and improve capital efficiency by striving to provide a total of 50 billion yen in shareholder returns.

Competition in the automotive industry is growing increasingly intense due to the rise of emerging manufacturers and the entry of players from other industries. The business environment is changing at a pace that sometimes defies expectations. However, we aim to capitalize on these changes as business opportunities and allocate resources appropriately and in a timely manner so that we can implement optimal strategies and tactics, using a backcasting approach from the future state we aspire to achieve. We will vigorously pursue business growth, and will aim to establish a virtuous cycle of sustainable growth and expanded returns by using the cash we generate for further investment in growth and shareholder returns.

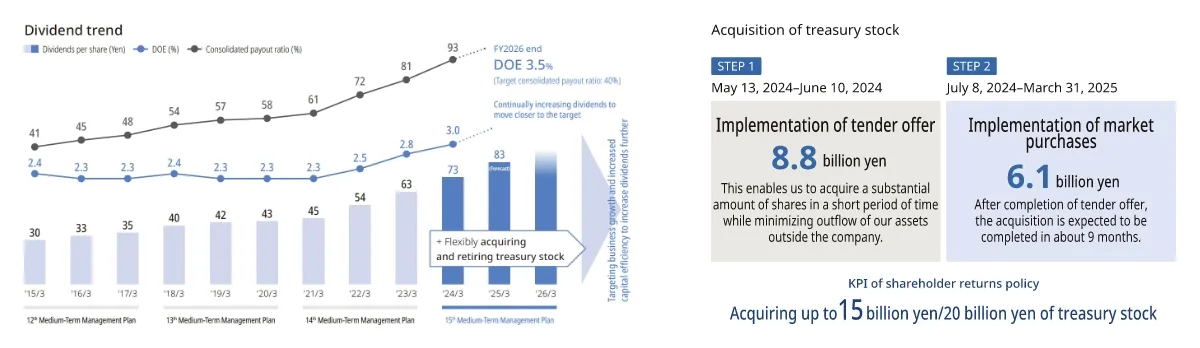

Returning profits to shareholders

The TS TECH Group recognizes that returning profits to shareholders is one of its important management issues. We have revised our policy for shareholder returns starting from the 15th Medium-Term Management Plan. We have set a new basic policy of “implementing sustained, stable returns unaffected by business results,” and we plan to provide a total of 50 billion yen in shareholder returns during our 15th Medium-Term Management Plan. We aim to achieve this by steadily increasing dividends to reach a DOE* of 3.5% or more by the end of the plan (fiscal 2026), and flexibly implementing approximately 20 billion yen in share buybacks which comprehensively consider our cash reserves, stock price levels, and other factors.

Under our new shareholder returns policy, the dividend for fiscal 2024 was 73 yen per share, 10 yen higher than in fiscal 2023. Furthermore, we plan to increase our dividend by 10 yen per share, taking it to 83 yen in fiscal 2025, thereby delivering 13 consecutive years of increasing dividends.

With regard to share buybacks, the Board of Directors, at its meeting on May 10, 2024, resolved to repurchase 15 billion yen worth of shares through a tender offer and market purchases. As announced on June 11, 2024, we acquired 8.8 billion yen worth of shares through the tender offer. We plan to purchase the remaining 6.1 billion yen from the market by the end of March 2025. We believe that repurchasing these shares will help to improve the capital efficiency of the Group, including EPS and ROE, and lead to returning profits to shareholders.

- Dividend on equity ratio (DOE) = Total dividends / Shareholders’ equity (Equity attributable to owners of parent)

Toward sustainable enhancement of corporate value

As of March 31, 2024, the Group’s price-to-book ratio (PBR) was only 0.78 (stock price: 2,010.5 yen), and we realize that, at present, this does not fully meet the expectations of stakeholders. Behind this is the fact that we have not managed to recover the high level of profitability we enjoyed before the pandemic and are facing a decrease in capital efficiency. Further business growth and obtaining earning power that exceeds the cost of capital will be essential to achieving an ROE of 8.5% during our 15th Medium-Term Management Plan. By strategically allocating resources from a medium- to longterm perspective, we aim to achieve a PBR of 1 or higher as soon as possible, by driving both the strengthening of profitability through investment in growth and the increase of shareholder returns, thereby enhancing corporate value and capital efficiency in a sustainable manner.

Although the business environment has grown more challenging than we envisioned when we formulated the 15th Medium-Term Management Plan, we still believe that the direction of the nine priority strategies is correct. What is important is to respond flexibly and implement these strategies more quickly. We aim to continue to be a company whose presence is valued and is sincerely appreciated not only by the capital market but also by all stakeholders. We will do this by supporting priority strategies for enhancing corporate value through financial strategies that accurately reflect changes in the business environment and by realizing ESG management through the development of our human resources to support our priority strategies and the strengthening of our corporate foundation.

Results by segment for fiscal 2024

Japan

This fiscal year, we began producing rear seats for the new Honda N-Box and the new Suzuki SPACIA.

We are working to further enhance our competitiveness in components by consolidating the functions of our parts division and constructing a new Production Technology Building in the Saitama district that will allow us to verify and test manufacturing technology and mass production.

The Americas

This fiscal year, we began production of seats for the new Acura TLX and other models. We are striving to reform our business structure to ensure profitability even in a severe business environment by introducing more advanced and highly efficient automated production equipment to coincide with the launch of new models.

China

This fiscal year, we began production of seats for the new Honda ODYSSEY and ACCORD and other models.

In the increasingly competitive Chinese market, we are striving to improve profitability by reducing costs through greater use of parts from local manufacturers and strengthening our sales activities for acquiring new customers.

Asia and Europe

This fiscal year, we began production of seats for the new Honda Elevate and new CR-V and other models in Asia.

To achieve further business growth, we are increasing the market share of our major customers and actively promoting sales activities to acquire new customers and expand our commercial rights.