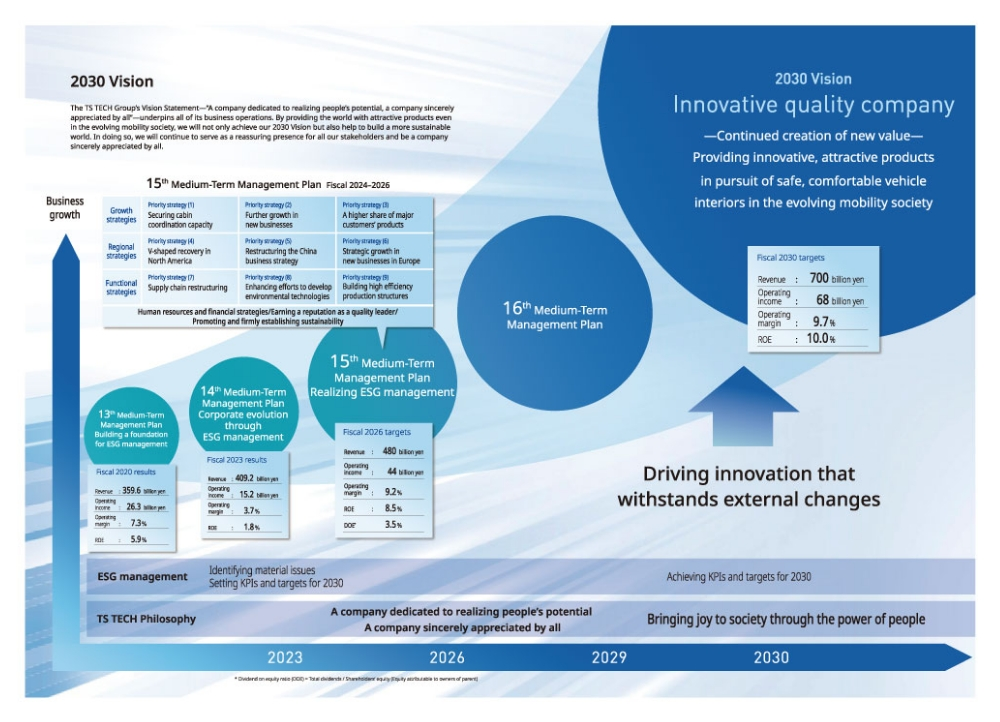

2030 vision

The TS TECH Group’s Vision Statement—“A company dedicated to realizing people’s potential, a company sincerely appreciated by all”—underpins all of its business operations. By providing the world with attractive products even in the evolving mobility society, we will not only achieve our 2030 Vision but also help to build a more sustainable world. In doing so, we will continue to serve as a reassuring presence for all our stakeholders and be a company sincerely appreciated by all.

Outline of the 15th Medium-Term Management PlanFiscal 2024–2026

Under the 15th Medium-Term Management Plan, we are first of all focusing on responding to the fast-changing market environment and recovering profitability as quickly as possible, in order to achieve further growth and deliver on our 2030 Vision. To do this, we will pursue nine priority strategies grouped into three areas: growth, regional, and functional. Also, seeking to bring to fruition the ESG management efforts we have implemented to date, we will aim to contribute to building a sustainable world, and will always strive to be a reassuring presence for all our stakeholders and a company sincerely appreciated by all.

| Management policy Realizing ESG management | ||

|---|---|---|

| Priority strategies | Initiatives and progress | |

| Growth strategies | 1 Securing cabin coordination capacity |

|

| 2 Further growth in new businesses |

|

|

| 3 A higher share of major customers’ products |

|

|

| Regional strategies |

4 V-shaped recovery in North America |

|

| 5 Restructuring the China business strategy |

|

|

| 6 Strategic growth in new businesses in Europe |

|

|

| Functional strategies |

7 Supply chain restructuring |

|

| 8 Enhancing efforts to develop environmental technologies |

|

|

| 9 Building high efficiency production structures |

|

|

| Foundation | Human resources strategies/ Financial strategies /Earning a reputation as a quality leader/Promoting and firmly establishing sustainability | |

|---|---|---|

To expand its business in the growing Indian automotive market, the TS TECH Group has established a joint venture with the Krishna Group, the main supplier of automobile seats for Maruti Suzuki. The new company, KRISHNA TS TECH AUTO PRIVATE LIMITED, will focus on the development and production of automotive interior components.

By combining the technologies and extensive know-how of both companies, we aim to establish a product development system that delivers greater added value. Through this, we will actively pursue new orders from Indian automakers and secure new commercial rights from existing customers.

To further enhance cost competitiveness, the Group is restructuring its supply chains both domestically and internationally. In Japan, we have improved operational efficiency by consolidating three parts-production subsidiaries into a single entity.

In the Americas, we are establishing an optimal supply chain based on regional trends. As part of this effort, we have shifted production of certain seat frame parts from Mexico to the United States to strengthen cost competitiveness.

Progress on financial goals

The consolidated earnings forecast for fiscal 2026, the final year of our 15th Medium-Term Management Plan, is expected to fall short of the targets: revenue of 430 billion yen, operating income of 16.5 billion yen, and an operating margin of 3.8%.

This shortfall is primarily due to significant changes in the automotive industry environment since the targets were set. These include sluggish sales by Japanese automakers in China, revised production plans for new models such as EVs, and persistently high material and labor costs in the Americas. As a result, profitability improvements remain at an early stage.

Given these developments, we recognize the considerable challenges in achieving our financial goals for 2030. Nevertheless, we remain committed to reassessing our strategies and financial targets proactively, while staying attuned to changes in the business environment.

*chart can be scrolled left and right.

| Financial targets | 14th Medium-Term Management Plan results |

15th Medium-Term Management Plan targets |

2030 targets |

|---|---|---|---|

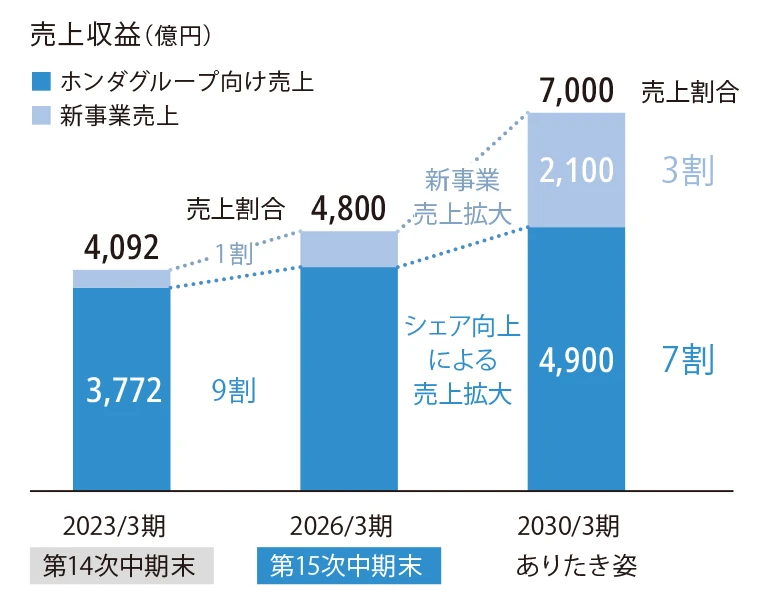

| Revenue (Billion yen) | 409.2 | 480 | 700 |

| Operating income (Billion yen) | 15.2 | 44 | 68 |

| Operating margin | 3.7% | 9.2% | 9.7% |

| ROE | 1.8% | 8.5% | 10.0% |

| Shareholder returns | |||

|---|---|---|---|

| Basic policy | Implementing sustained, stable returns unaffected by business results | ||

| Dividends | Stable increase in dividend payments, targeting DOE of 3.5% or more by the end of the 15th Medium-Term Management Plan | ||

| Acquisition of treasury stock | Flexible share buyback during the term of the 15th Medium-Term Management Plan amounting to cumulative total of approximately 20 billion yen and appropriate retirement of treasury stock | ||

Generating Value in Four Regional Segments

The TS TECH Group organizes its business operations into four regional segments, with Japan as one of them.

We are committed to achieving sustainable business growth by expanding our business opportunities,

introducing automation equipment, reducing production losses, and improving cost efficiency.

※The table can be scrolled left and right.

| Japan | The Americas | China | Asia and Europe | |

|---|---|---|---|---|

| Number of affiliated companies in the TS TECH Group※1 | 8 | 16 | 9 | 12 |

| Number of employees※2(People) | 2,274 | 8,232 | 1,769 | 1,888 |

| Motorcycle business revenue※3(Million yen) | 4,379 | 300 | — | 3,523 |

| Automobile business revenue※3(Million yen) | 68,547 | 254,123 | 68,019 | 38,533 |

| (Seats) | 65,439 | 225,794 | 66,545 | 35,424 |

| (Interior products) | 3,108 | 28,329 | 1,474 | 3,109 |

| Revenue from other businesses※3(Million yen) | 15,069 | 7,921 | — | 95 |

| Total※3(Million yen) | 87,995 | 262,345 | 68,019 | 42,153 |

| Capital expenditures(Million yen) | 6,330 | 11,588 | 1,597 | 2,138 |

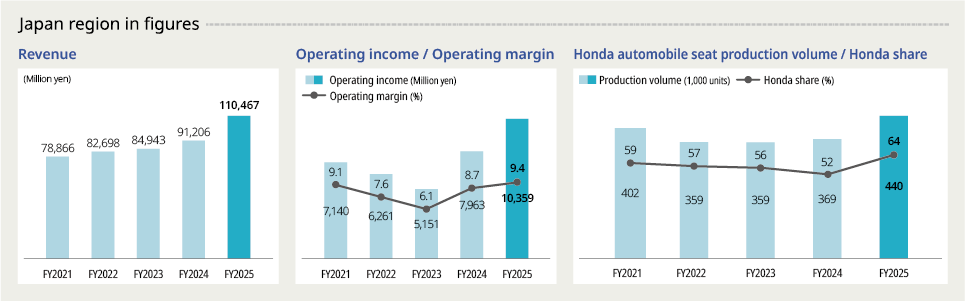

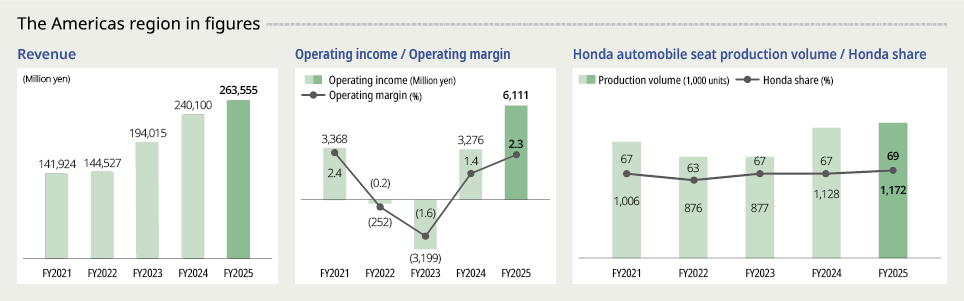

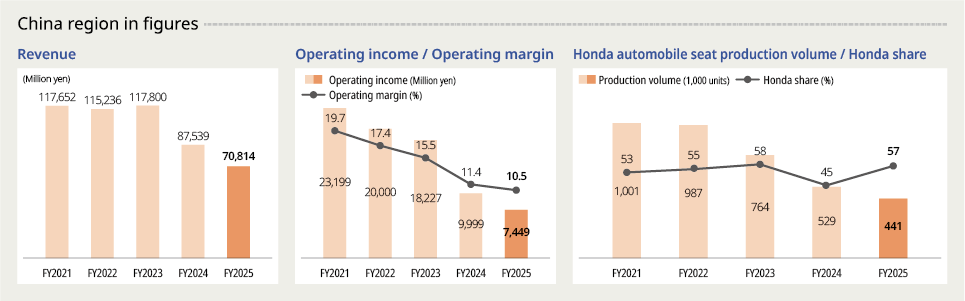

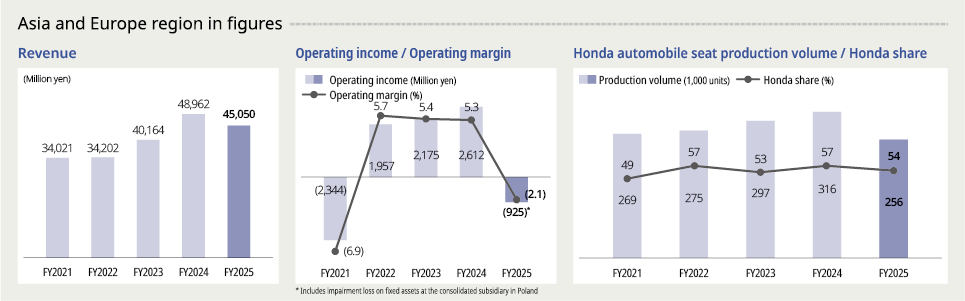

| Revenue (Million yen) | 110,467 | 263,555 | 70,814 | 45,050 |

| Operating income (Million yen) | 10,359 | 6,111 | 7,449 | (925) |

| Operating margin (%) | 9.4 | 2.3 | 10.5 | ー |

As of the end of March 2025

- This number includes TS TECH, its subsidiaries, and major overseas affiliates.

- This number includes employees of TS TECH and consolidated subsidiaries.

- Inter-segment transactions are eliminated by offsetting and only revenue from sales to external customers is presented.

Segment Market Analysis

As the market environment in each region and the global situation continue to change, the business environment in each segment where the TS TECH Group operates is also undergoing significant transformations. In order to respond accurately and effectively to these changes, we have incorporated regional strategies into the 15th Medium-Term Management Plan, and are accelerating measures tailored to the characteristics of each region.

Japan Region

Market Analysis

Demand in Japan’s automobile market continues to shrink due to structural societal changes, including a falling birthrate, an aging society, an overall population decline, and a trend among younger generations moving away from car ownership. Moreover, the automobile market is already mature, and demand is mainly driven by vehicle replacement. Against this backdrop, product development tailored to the diversification of customer needs and their evolving lifestyles will significantly influence sales trends. In response, competition among automakers has intensified, and in addition to cost competitiveness, the overall strength of their products, including quality, fuel efficiency, comfort, and safety, is now under scrutiny. In addition, changes in the external environment, such as increases in material prices and logistics costs, are also adding risks to profitability.

Furthermore, as a result of production site optimization efforts by our customers, there has been an increase in cases in which foreign-manufactured models are supplied to the domestic market. Consequently, within the TS TECH Group, the composition of production models in the Saitama region is changing, requiring us to adapt to production systems that differ from the traditional ones. On the other hand, in the Hamamatsu region, we have started production of rear seats for the Suzuki Spacia under a newly acquired order, and production operations continue to run steadily.

■Current Challenges

Going forward, as the intense competition among automakers continues, it will be crucial to transform the company into a more resilient organization capable of securing stable profits while responding in a flexible manner to fluctuations in our customers’ production volumes. In the production domain, it is essential to further expand automation of processes within plants, including part conveyance, assembly, inspection, and shipment. We also need to enhance production efficiency and flexibility in order to build a structure that can swiftly respond to increasingly diversified product needs. Meanwhile, new technological developments, such as automating product inspection through the proactive utilization of AI and other digital technologies and reducing maintenance and troubleshooting workloads through systems that monitor for early signs of equipment problems, will be essential to enhancing our future competitiveness.

■Future Goals

In the Japan region, while further improving the production efficiency of each plant, we will also aim to establish a base for developing production technologies that support more stable, highly efficient manufacturing, which will serve as the mother plant for the TS TECH Group.

Specifically, at the newly constructed Production Technology Building at the Saitama Plant, we will conduct preliminary verification of product specifications and manufacturing equipment using pilot lines for new models. Through these efforts, we will ensure a smooth transition from development to mass production, while providing support to our group bases around the world. We will also accelerate research and development to enable the early adoption of digitally enabled manufacturing technologies, and will strive to improve profitability by establishing a highly efficient production system.

The Americas Region

Market Analysis

Annual new vehicle sales in the United States, the largest automotive market in the Americas, exceeded 16 million units in 2024, marking the highest level since before the COVID-19 pandemic. This indicates that the market is gradually recovering. Despite expectations for continued steady growth going forward, the shift in U.S. environmental policies has slowed EV sales, resulting in revisions to our customers’ development plans, increasing market uncertainty. Furthermore, depending on U.S. trade policy trends, it may become necessary to revise and reconfigure production allocations across the entire supply chain, raising concerns about potential disruption throughout the industry. On top of this, labor costs continue to rise due to wage increase demands from the United Auto Workers, among other factors. Together, these developments create complex challenges that require a flexible response.

■Current Challenges

We recognize that, in order to achieve “V-shaped recovery in North America,” which is one of the priority strategies under the 15th Medium-Term Management Plan, we must address the key challenges of advancing automation and enhancing operational efficiency, while reducing reliance on human labor. Amid uncertain market trends, including industry-wide production allocation revisions and the uncertain progress of EV adoption, establishing a production system capable of flexible response is an urgent priority.

Compliance with environmental regulations, such as achieving carbon neutrality and the mandatory use of recycled materials, represents an unavoidable challenge over the long term. In the face of these environmental changes, it is also crucial to secure stable procurement for parts and materials, as well as reliable logistics.

■Future Goals

We are gradually establishing a production system that can flexibly respond to fluctuations in the volumes of both EVs and gasoline-powered vehicles. At the same time, we are promoting the development of a supply chain capable of stable parts procurement under any circumstances. By building a resilient and high-margin operating model that can withstand environmental changes, we aim to achieve a strong V-shaped recovery in profitability.

Enhancing the profit structure in the North American region is not merely a short-term objective aimed at addressing immediate challenges. We believe that it will serve as the foundation for strengthening the TS TECH Group’s overall profit structure with a future-oriented, long-term perspective. Going forward, we will continue to pursue rigorous efficiency improvements through automation and other initiatives, striving to achieve a transformation toward a highly profitable structure.

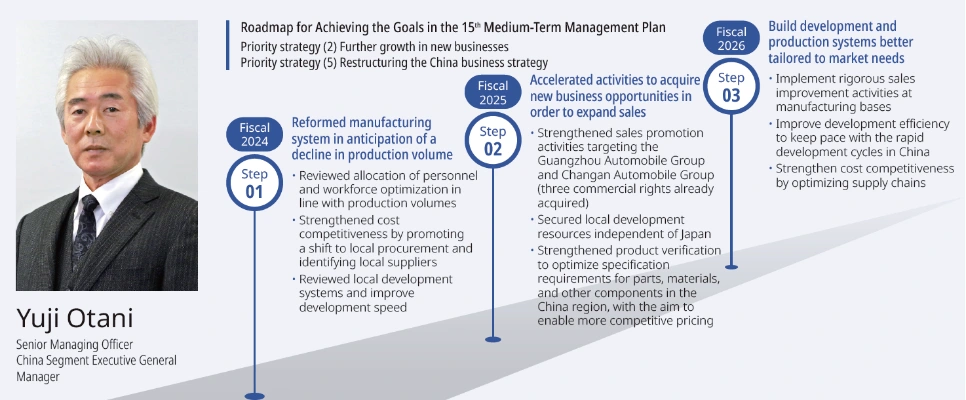

China Region

Market Analysis

In the China region, the market environment has been undergoing drastic changes in recent years due to the emergence of Chinese automakers that have swiftly responded to the expansion of the EV market. As a result, Japanese automakers, along with their counterparts from other countries, are facing unprecedented challenges. Even under these circumstances, the TS TECH Group promptly recognized the changes in the market environment and has been working to improve profitability by vigorously pursuing optimization of its production system since 2023. Despite these efforts, however, as in the previous fiscal year, we were forced to report a decline in both revenue and profit for fiscal 2025, due to the impact of significant production cuts by our customers, which exceeded our initial expectations. This remarkable growth of Chinese manufacturers is expected to continue in the future, driven by plug-in hybrid EVs and battery EVs that combine cutting-edge technologies and functionality on par with global automakers with overwhelming price competitiveness.

■Current Challenges

The current automotive need in the China region is to combine cutting-edge technologies and functionality with low prices. Against this backdrop, we recognize that the most pressing challenge for the TS TECH Group is to boost our cost competitiveness. Previously, we set our specification requirements for materials and parts in accordance with Japanese quality standards. However, to compete effectively, we must reduce production costs through every possible means—by aligning with the local standards adopted by Chinese automakers, improving manufacturing processes, and lowering fixed costs. In addition, securing new orders to drive sales growth remains a key priority. We also recognize the importance of building a development framework and securing resources that can keep pace with China’s uniquely fast development cycles.

■Future Goals

The market environment in the China region remains challenging. However, as a vast market that continues to grow even as the number of domestically sold new vehicles has exceeded 30 million, China remains a region of crucial importance to the TS TECH Group in terms of our business strategy. It is precisely during such challenging times that opportunities for significant growth arise. We will further strengthen our trusted cooperative relationships with various automakers, including our main customer, Honda Motor, as well as with our joint venture partners who collaborate with us in business operations. Simultaneously, we will advance key initiatives by concentrating on both strengthening our development and manufacturing capabilities and expanding sales. These initiatives will help us solidify our position in the Chinese market as a supplier of automotive interior products.

Asia and Europe Region

Market Analysis

The market environments in Thailand, Indonesia, and India, the TS TECH Group’s key Asian production hubs for automobile seats, are diverging. While automobile production in Thailand and Indonesia peaked in 2018 and has stagnated since, annual production in India exceeded six million units in 2024 and is expected to continue growing substantially in the future. The rise of Chinese automakers backed by government-led EV promotion policies in each country and the growth of Korean and local manufacturers in India are causing significant fluctuations in the automobile market shares across those countries. In this environment, the TS TECH Group, whose main customer is the Honda Group, continues to face intense competition in each country. Meanwhile, the EV market in Europe has plateaued, and development schedules among European automakers are being delayed, contributing to rapid and ongoing changes in the regional market environment.

■Current Challenges

The automotive market in Asia is expected to continue growing in the future, and expansion of sales in this region will become a crucial driver of the sustainable growth of the TS TECH Group. However, as the brand power of Japanese automakers shows signs of weakening, maintaining our traditional business model, which targets only a limited customer base, could limit our future opportunities. As an urgent priority, we must explore new approaches that do not rely on past success models and work to acquire new customers and new commercial rights. Furthermore, contributing to profits through cross-regional cost reductions that leverage the characteristics of the Asian region, where we operate across multiple countries, will be essential to enhancing the competitiveness of the TS TECH Group.

■Future Goals

Acquiring new customers and new commercial rights is our highest priority in Asia. In 2025, we established a joint venture company for seat development and automobile part manufacturing with the Krishna Group, a major seat supplier to Maruti Suzuki, which holds a leading share in the Indian automobile market. By leveraging the joint venture’s development capacities tailored to local needs, we will aim not only to strengthen and expand the Maruti Suzuki account but also to secure new orders from domestic Indian automakers. We have also revamped our existing sales structure in Thailand and established a business development unit at the regional headquarters, which has begun implementing new approaches to engage potential customers. We will strive to ensure that these initiatives deliver tangible results, positioning the Asia region as the growth engine of the TS TECH Group.