Message from the President

Continuing to embrace

challenges and enhance

corporate value in a changing

business environment

Masanari Yasuda

President and Representative Director

As we work to realize the TS TECH Group 2030 Vision of being an “Innovative quality company—continued creation of new value,” we are moving forward on our 15th Medium-Term Management Plan (fiscal 2024–2026). In fiscal 2025, the second year of the plan, the Group continued to face challenging business environments in each region, with ongoing sluggish sales for Japanese automakers in the Chinese market, as well as persistently high manufacturing costs due to rising raw material and labor costs. In light of the global EV shift slowing, automakers are also revising development and production plans, leading to greater uncertainty about the future. Despite these challenging circumstances, we remain steadfast in our commitment to further enhancing corporate value. Under the unwavering banner of our TS TECH Philosophy, we will proactively allocate management resources to essential growth areas based on priority strategies in the categories of growth, regional, and functional.

Progress on the 15th Medium-Term Management Plan

For our first growth strategy, “securing cabin coordination capacity,” the TS TECH Group is accelerating product development with an eye on next-generation vehicles. Advances in technologies such as self-driving are transforming automobile cabins from mere transportation spaces into environments that deliver new value to users. We take a long-term view, aiming to transform into a company capable of coordinating the cabin space and create compelling and comfortable spaces for users.

In November of last year, we held our second proprietary technology exhibition, Next-Generation Automotive Cabin Exhibition 2024 . The event drew a large number of automakers who were given the opportunity to experience the Group’s cutting-edge technology firsthand. We earned high marks from customers, along with valuable feedback on areas for improvement. Leveraging the feedback we received, we have identified technical areas that require further refinement. In addition, as the technologies of interest differ by each automaker, we will pursue more efficient R&D and steadily advance proposals for product solutions that exceed expectations, driving further growth in new businesses and winning a higher share of major customers’ products.

In terms of generating further growth in new businesses , the slowdown in EV demand has postponed development and production plans at automakers and delayed planned orders from new customers. At our European sites, however, order volumes continue to grow, supported by the launch of production of third-row seat frames for the Volkswagen ID. Buzz. Moreover, with an eye toward securing future commercial rights, we have established a joint venture for seat development and parts manufacture with the Krishna Group, the main supplier of automotive seats for Maruti Suzuki vehicles in the Indian market, which is expected to see growing automotive demand. By inegrating the two companies’ resources, including in technology and expertise, we will actively pursue new orders to acquire new customers and new commercial rights, including with domestic automakers in India.

In order to secure a higher share of major customers’ products , we are working to further expand orders in our Honda partnership, the most important foundation of our Group operations, while also pursuing new customers and new commercial rights. To increase our share in the Honda business, steady orders for existing commercial rights and expanding orders for new commercial rights are essential. I view this period of rapid change in the automotive industry as an opportunity. We will continue to collaborate with our customers from the early stages of development, proposing competitive solutions to develop attractive products that reflect regional characteristics.

In terms of our regional strategy for a V-shaped recovery in North America , we face profitability challenges due to multiple factors, including increased labor costs and production losses caused by irregular production schedules, as well as persistently high raw material costs. In response, we are carrying out active capital investment in effective measures such as deploying automated equipment across production sites to help reduce production losses. Further, we are working to improve our profit structure by undertaking structural reforms that extend beyond production areas to include back-office operations. These initiatives have steadily improved profits, and we will continue to enhance profitability by further reducing production losses.

With regard to restructuring the China business strategy , the rapid rise of Chinese EV automakers has forced Japanese automakers into a prolonged struggle and an ongoing challenging business environment. Under these circumstances, we anticipated such market shifts early on and have been taking proactive steps, including optimizing staffing, restructuring production bases, and expanding partnerships with local suppliers. Further, we are making steady progress in securing new commercial rights from new customers, acquiring them from Changan Automobile and the Guangzhou Automobile Group. Through the early development and steady production launch of models scheduled to begin in fiscal 2026, we aim to secure even more commercial rights to ensure our continued success in the increasingly competitive Chinese market.

With regard to progress made in the 15th Medium-Term Management Plan, we have achieved approximately 70% of our overall goals. Although we have made smooth progress on key strategies, the external environment has changed significantly since our plan was initially formulated, impacting certain strategies. We believe, however, that the direction underlying our strategies remains appropriate at this time. By steadily implementing relevant measures and achieving accumulating results, we will solidify the foundation for our 16th Medium-Term Management Plan (fiscal 2027–2029) to drive greater business growth.

Priority Strategies under the 15th Medium-Term Management Plan

Management policy

Realizing ESG management

Growth

strategies

Priority strategy (1)

Securing cabin

coordination capacity

Priority strategy (2)

Further growth in

new businesses

Priority strategy (3)

A higher share of major

customers’ products

Regional

strategies

Priority strategy (4)

V-shaped recovery in North America

Priority strategy (5)

Restructuring the China

business strategy

Priority strategy (6)

Strategic growth in

new businesses in Europe

Functional

strategies

Priority strategy (7)

Supply chain restructuring

Priority strategy (8)

Enhancing efforts to develop

environmental technologies

Priority strategy (9)

Building high efficiency

production structures

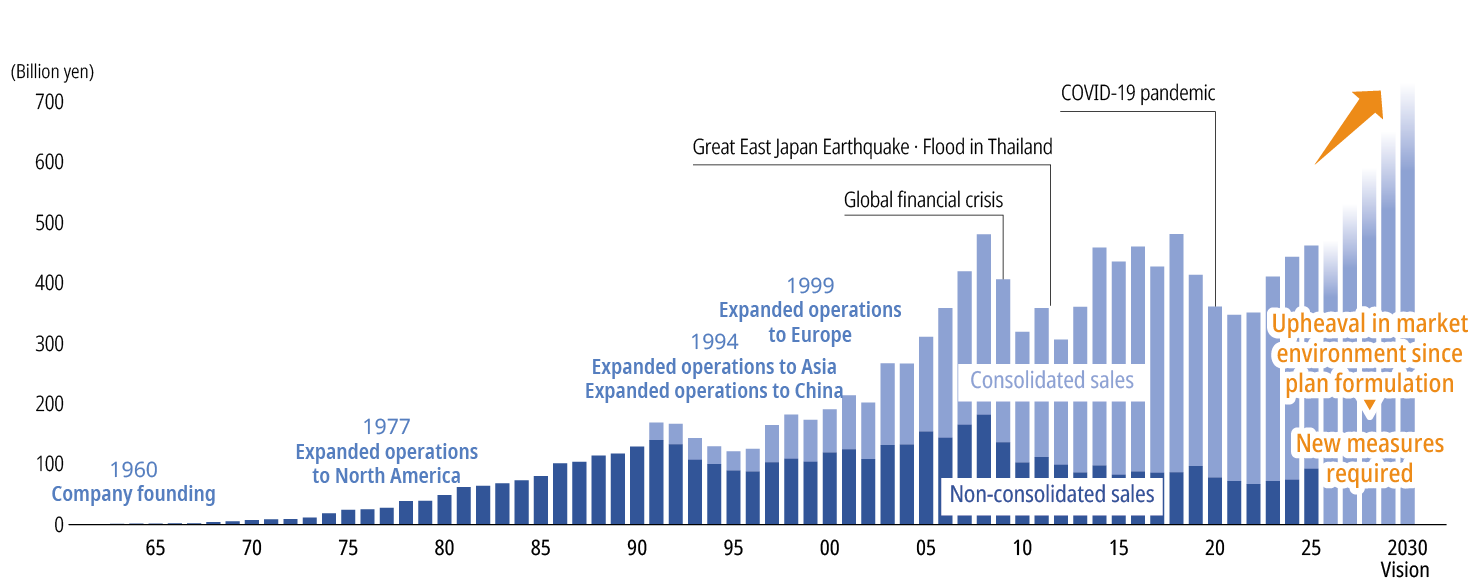

History of growth

Continuing to grow corporate value

Since its founding in 1960, the TS TECH Group has steadily grown with the expansion of the automotive industry. Despite temporary declines in sales caused by global financial crises and natural disasters, we have overcome each of these challenges to build the solid business foundation we have today.

Today, however, the automotive industry as a whole is confronting a challenging environment, and we recognize that the Group has reached a plateau in its growth. Since we formulated our 15th Medium-Term Management Plan, production volume plans and other factors on which our profit targets are based have changed significantly. New measures to ensure sustainable business growth are now required to achieve our 2030 Vision.

The TS TECH Group is currently exploring various possibilities for further expanding our business scale, including growth investments such as M&A in our areas of expertise, leveraging our capital resources. As we prepare for the 16th Medium-Term Management Plan, we are formulating strategies based on these initiatives so that our stakeholders can look forward to continued growth.

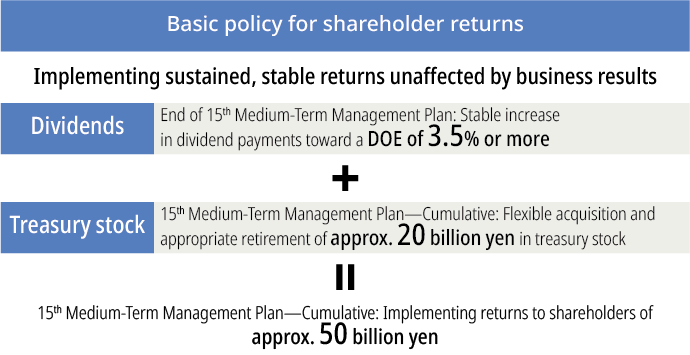

Newly implemented measures will take a certain amount of time to yield results. In the meantime, we continue to steadily advance shareholder returns as originally planned, based on our shareholder return policy. The final fiscal year of the 15th Medium-Term Management Plan calls for steadily increasing dividends, targeting a DOE※1 of 3.5% or more, and returning approximately 50 billion yen to shareholders through flexible share buybacks and retirements over three years. At this time, we expect to meet these shareholder return targets and, going forward, will continue to strive to continuously grow corporate value by implementing appropriate shareholder return measures, including maintaining and improving the DOE.

- Dividend on equity ratio (DOE) = Total dividends / Shareholders’ equity (Equity attributable to owners of parent)

Growing corporate value with sustainability initiatives

Given that the challenging market environment is expected to persist, I believe a sustainability-driven business structure is essential to achieving further business growth. This does not, however, represent a major shift in our corporate policy. It is simply a matter of deepening our practice of the TS TECH Philosophy , in other words, delivering on the value of our existence. This philosophy, which calls for us to be “A company dedicated to realizing people’s potential” and “A company sincerely appreciated by all,” has always been fundamentally aligned with sustainability, and our Group has consistently maintained an approach of growing together with society.

Specifically, we have identified material issues based on this philosophy and established 2030 targets with corresponding KPIs to help realize a sustainable society. As a member of the automotive industry directly involved in CO₂ emissions, we consider addressing climate change a particularly urgent priority. We have endorsed the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD)※2 and are working to enhance our disclosure practices. In addition, we began expanding our scope of disclosure in fiscal 2025 to include the Taskforce on Nature-related Financial Disclosures (TNFD)※3 initiative , and we are strengthening our consideration of biodiversity and natural capital. Leveraging these international frameworks, we will accurately reflect taskforce recommendations in our management strategy and risk management to accelerate our sustainability initiatives.

Being “A company sincerely appreciated by all” is not simply a matter of being appreciated by customers, business partners, shareholders, and local communities. I firmly believe that we must be a Group in which our employees — the very source of the value creation needed to succeed in the automotive industry of the future—feel joy and fulfillment in their work and experience true growth. To ensure this, it is essential that we create an environment in which every employee is able to continue to embrace challenges . One initiative designed to achieve this is our employeedriven job rotation scheme, available to all employees including managers. Under this scheme, employees are interviewed regarding their desired transfer destinations, and if a match is found between individual preferences and internal staffing needs, the transfer is carried out. This encourages employees to be more actively involved in building their careers. Another employee-centered initiative is our internal job posting system. It allows employees to apply for internal career hiring opportunities across all departments. In terms of our approach to creating a comfortable work environment, we are also focused on improving systems that support flexible working arrangements, including removing monthly limits on the use of the telecommuting system in line with individual circumstances such as caregiving responsibilities. In addition, we introduced a new trust-based stock compensation program for managers, similar to an employee stock ownership plan, and to commemorate our 65th anniversary, we distributed 65 shares of treasury stock as restricted stock compensation to all employees, including general staff. These initiatives aim to boost employee motivation while fostering a mindset that contributes to enhancing corporate value from the same perspective as our shareholders. Through these and other efforts, we are working to create a multifaceted environment that accommodate our employees’ diverse values and working styles.

- ※2 The Task Force on Climate-related Financial Disclosures is an international framework for identifying, assessing, and disclosing risks and opportunities presented by climate change.

- ※3 The Taskforce on Nature-related Financial Disclosures is an international framework for identifying, assessing, and disclosing risks and opportunities related to natural capital and biodiversity.

In conclusion

The TS TECH Group will continue to leverage its organizational strength to drive further business growth while contributing to a sustainable society. We are committed to building a resilient corporate structure that can flexibly respond to change. Even amid an increasingly uncertain business environment, we are steadily taking steps toward a promising future. Moving forward, we will continue to grow alongside society, striving tirelessly to enhance corporate value through sustainable value creation and a spirit of continuous challenge. Through these efforts, we aim to remain a company sincerely appreciated by all stakeholders. We appreciate your continued support.