Initiatives for Climate Action and Biodiversity Conservation

- Information Disclosure Based on TCFD Recommendations

- Governance

- Risk Management

- Metrics and Targets

- Strategy

- Membership in the TNFD Forum

- Natural Capital and Biodiversity Initiatives

- Locate: Locate the interfaces with nature

- Evaluate: Evaluate dependencies and impact

- Future Initiatives

- Green Ecosystem Conservation Activities

- Support Activities Aimed at Coexisting with Nature

Information Disclosure Based on TCFD Recommendations

As a company involved with the manufacture of automobiles that directly emit CO2, we recognize our response to climate change as a serious management issue. Accordingly, in August 2021 the Group endorsed the recommendations of the TCFD. We will analyze the risks and opportunities climate change presents to the Group’s operations, reflect these in our management strategy and risk management, and appropriately disclose progress in order to contribute to a decarbonized society and aim for further growth.

Governance

We have established the Sustainability Committee, which deliberates on issues related to all domains of sustainability, including our response to climate change, and manages sustainability for the Group as a whole.

Risk Management

Risks and opportunities related to climate change and other sustainability issues are reviewed annually and deliberated upon by the Sustainability Committee. Major risks and opportunities are identified by classifying risks and opportunities arising from climate change as transition risks or physical risks and qualitatively assessing their fiscal impacts.

Identified major risks and opportunities that are physical risks (response to natural disasters) are addressed using targeted measures promoted by each functional division and region via the Global Risk Management Committee. Transition risk-related matters directly linked to business activity will be incorporated into medium-term management plans and business strategies and promoted in accordance with enacted policies. Items related to sustainability (long-term environmental targets, materiality KPIs, etc.) will be promoted by each functional division and region via the Sustainability Committee.

- Information gathering

- Information gathering regarding risks and opportunities related to climate change led by each functional division and region

- Identification of major risks and opportunities

- Evaluation and analysis based on gathered information, such as the degree of impact on operations and the possibility of occurrence, to identify the Group’s major risks and opportunities related to climate change

- Selection of policies and measures

- Creation of policies and measures for risks and opportunities that are deliberated upon by the Sustainability Committee and presented at a Board of Directors’ meetings as necessary once measures are passed at meetings of the Executive Committee

- Incorporation into strategies

and

implementation -

Identified major risks and opportunities will be handled as follows:

- Each functional division and region will promote measures to address natural disaster risks via the Global Risk Management Committee

- Business-related matters will be addressed through incorporation into medium-term management plans and business strategies

- Each functional division and region will promote measures to address sustainability via the Sustainability Committee

Metrics and Targets

In March 2021, the Group identified the eight material issues (materiality) it will prioritize to help contribute to the creation of a sustainable world, and it set KPIs and targets for 2030 for each material issue. The Group set long-term environmental targets that include a reduction in CO2 emissions compared to fiscal 2020 by 50% in 2030 and 100% in 2050, and it is working to achieve them by installing energy-conserving equipment and utilizing renewable energy at each location.

Strategy

Measures to achieve carbon neutrality are essential for realizing a sustainable society. It is expected that governments worldwide will implement energy regulations to reduce CO₂ emissions and stronger laws, and it is also anticipated that various regulations related to automobiles will be strengthened. While tighter regulations could be a risk to the Group, addressing them by focusing our efforts on products and services with outstanding environmental performance, one of the Group’s strengths, could be an opportunity to expand business operations.

We believe that moving forward, the promotion of Group products and services that comply with changing regulations and laws is not only an effective measure to help control global greenhouse gas emissions, such as CO₂ but also an opportunity for the Group’s business growth, and we have incorporated this belief into our business strategies.

Analysis of Risks and Opportunities Based on Climate Change Scenarios

A scenario analysis was conducted using the Group’s core automobile business (seats, interior components), and business risks and opportunities were identified. Matters arising from a transition to a decarbonized society, such as tighter regulations and technological developments or market changes, and matters arising from the physical impact of climate change, such as acute extreme weather and chronic temperature rises, are examples of risks and opportunities related to climate change.

The Group classified the causes for various changes in the external environment arising from climate change as “physical risks” or “transition risks” and qualitatively assessed the fiscal impacts using the three levels of large, moderate, and small to identify major risks and opportunities. It also assessed the potential impacts of important risks and opportunities, and performed quantitative evaluations based on the assumed financial impact amount. The analysis examined the period up to 2050, and, in line with the Group’s long-term environmental targets, set 2030 as the medium term and 2050 as the long term.

Scenario Analysis

An analysis was conducted using a “4°C scenario” where the physical impact of intensifying extreme weather caused by climate change is apparent and a “1.5°C scenario” where the effects of a transition to carbon neutrality are evident.

| Assumed scenario |

Reference scenarios | Assumed state of society |

|---|---|---|

| 4°C scenario |

|

|

| 1.5°C scenario |

|

|

Risks and Opportunities Related to Climate Change and Related Responses

The risks and opportunities judged as having a large or moderate fiscal impact on the Group’s operations using a scenario analysis are as follows.

Principal Risks

| Risk classification | Identified risks | Medium- or long-term | Potential financial impact | Mitigation | Relevant initiatives and indicators | |

|---|---|---|---|---|---|---|

| Physical risks (4 °C warming scenario) |

Acute | Potential decrease in sales due to suspension of operations at Group sites caused by extreme weather events such as typhoons, torrential rains, and hurricanes | Long | [Impact: Large] The potential decrease in revenue due to a shutdown caused by flooding is estimated to be up to 5 billion yen per affected site |

|

|

| Transition risks (1.5°C warming scenario) |

Government policies Laws and regulations |

Need to adopt renewable energy and increase capital expenditures due to stricter regulations | Medium | [Impact: Large] An estimated investment of around 7 billion yen will likely be required by 2030 for the transition to renewable energy, including the adoption of solar power technology |

|

|

| Higher operating costs due to widespread adoption of carbon taxes | Medium | [Impact: Moderate] By 2030, the Group could be paying around 700 million yen in carbon taxes for its emissions |

|

|||

| Technology | Higher R&D costs and greater capital expenditures to create low-carbon and electrified products | Medium | [Impact: Large] Higher R&D expenses are anticipated to make products with low environmental impact, to improve manufacturing technology, and to develop products for EVs, along with a corresponding increase in capital expenditures. |

|

|

|

| Market | Higher raw material procurement costs due to carbon taxes and the need to adopt more eco-friendly materials | Medium | [Impact: Large] By 2030, the Group could be paying carbon taxes of 40 billion yen on transactions with suppliers |

|

|

|

| Potential drop in sales due to a lack of low-carbon and EV products | Medium | [Impact: Large] The market is expected to shift to EVs and the need to reduce the product environmental impact will increase. If the Group is unable to provide products that meet customer needs, it could see a decline in sales of around 100 billion yen by 2030 |

|

|

||

Main Opportunities

| Risk classification | Identified opportunities | Medium- or long-term | Potential financial impact | Mitigation | Relevant initiatives and indicators | |

|---|---|---|---|---|---|---|

| Opportunities (1.5 °C warming scenario) |

Resource usage efficiency | Decrease in operating costs due to more efficient production processes | Medium | [Impact: Moderate] By 2030, energy conservation measures could yield a cost reduction effect of approximately 500 million yen |

|

|

| Products and services | Due to increased demand for low-carbon products, the Group will likely sell more seats for EVs and interior components made from eco-friendly materials | Medium | [Impact: Large] Enhancing product lines compatible for EVs will likely lead to the acquisition of new customers and the expansion of commercial rights. By 2030, the resulting increase in annual revenue could reach 70 billion yen |

|

|

|

| Increased revenues due to sales of new products compatible with next-generation vehicles | Medium | [Impact: Large] By enabling product coordination with the entire vehicle interior, and by developing products that meet new requirements for next-generation vehicles, we will likely acquire new customers and expand our commercial rights. By 2030, this could result in an increase in annual revenue of about 35 billion yen |

|

|

||

Membership in the TNFD Forum

In August 2025, the TS TECH Group endorsed the principles of the Taskforce on Nature-related Financial Disclosures (TNFD) and joined the TNFD Forum, an international organization established to support the TNFD’s activities.

We will assess the risks associated with the impact the Group’s business activities have on nature and the resulting loss of natural resources. We will incorporate these findings into our management strategy and risk management, strive for appropriate disclosure, and collaborate with stakeholders to advance initiatives related to natural capital and biodiversity.

Natural Capital and Biodiversity Initiatives

The TS TECH Group has established 2030 targets for materiality (key issues) to realize a sustainable society. Regarding natural capital and biodiversity, we are implementing targets and measures focused on “resource circulation and effective utilization” and “coexistence with nature.”

In recent years, it has become crucial to analyze and evaluate the dependence on and impact on nature associated with business activities and to take measures to prevent the loss of natural capital. The Group has also conducted a trial analysis and evaluation.

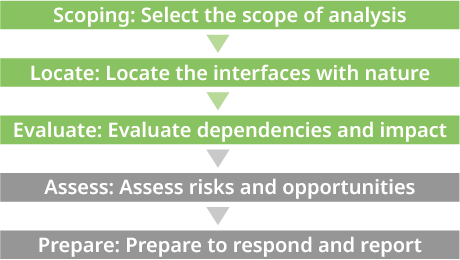

LEAP Approach

Based on the LEAP Approach*1 recommended by the TNFD, we conducted analyses related to “Locate” and “Evaluate.”

- A methodology for companies to evaluate and manage their relationship with the natural environment, systematically organizing the steps to achieve naturepositive management

Scoping: Select the scope of analysis

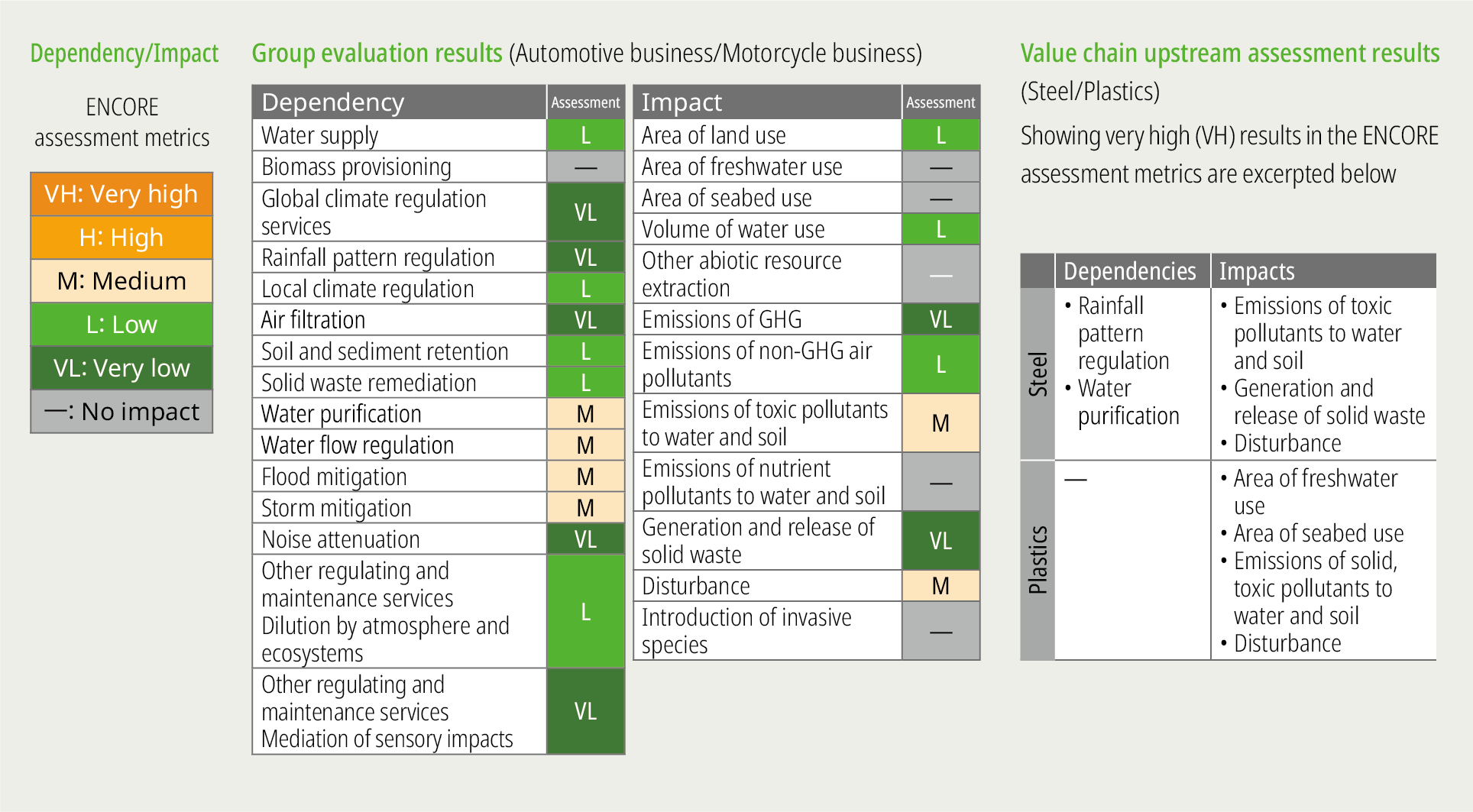

For this analysis, the Group set its scope as its core businesses— automotive and motorcycle operations—based on the results of the ENCORE*2 assessment tool recommended by the TNFD for evaluating dependencies on and impacts to natural capital, as well as the scale of these operations.

In the value chain, we set the scope as steel and petroleum-derived plastics for key upstream raw materials, referencing the High Impact Commodity List published by the Science Based Targets Network (SBTN).

*2 A tool that visualizes potential dependencies on and impacts to nature

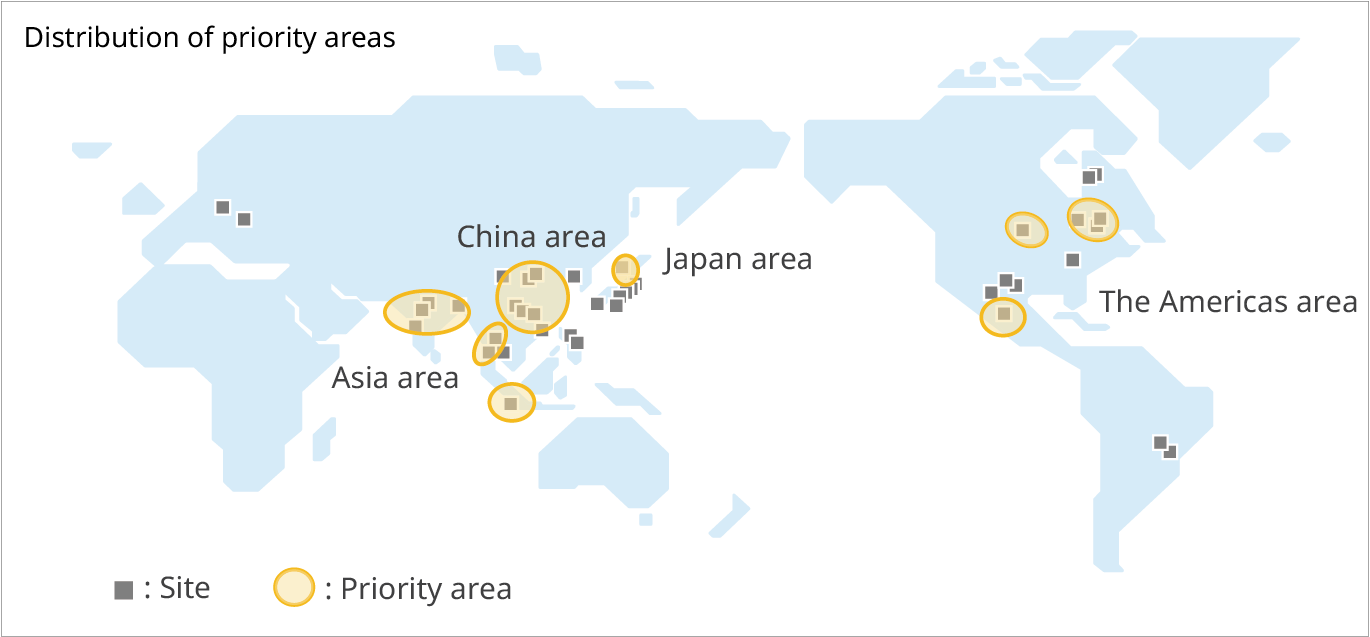

Locate: Locate the interfaces with nature

We identified priority areas*3 based on the location information of TS TECH Group’s business sites.

For identification, we used the following assessment tools recommended by the TNFD.

*3 Areas with significant dependencies on or impact to natural capital as defined by the TNFD

*The table can be scrolled left and right.

| Criteria for identification of priority areas | Assessment tool |

|---|---|

| 1 Areas critical for biodiversity |

|

| 2 Areas with high ecosystem intactness |

|

| 3 Areas experiencing rapid decline in ecosystem intactness |

|

| 4 Areas with high physical water risk |

|

| 5 Areas where ecosystem service provision is important, including benefits to indigenous peoples, local communities, and stakeholders |

|

<Assessment results>

Within the Group, we have identified 20 locations as priority areas.

Multiple areas were confirmed to be important for biodiversity or to have high physical water risks.

Regarding the upstream value chain, we will proceed with assessments to identify risks going forward.

Evaluate: Evaluate dependencies and impact

We assessed the Group’s dependencies on and impact upon natural capital in upstream business activities within the value chain and organized the findings using a heat map. For the assessment, we used the TNFD-recommended tool ENCORE. Please note that our assessment results are based on the initial assessment conducted via ENCORE, with adjustments made to dependencies and impacts considering TS TECH’s specific circumstances.

<Assessment results>

The Group analyzed dependencies and impacts separately for the automotive and motorcycle businesses. However, due to the similarity of their business processes, the assessment results were virtually identical.

Although the overall dependency level of the Group was found to be low, we confirmed that it has dependencies on functions such as water purification and flood mitigation.

Regarding impacts, while the negative impact was similarly small, we confirmed that there are impacts to the ecosystem in the category of “emissions of toxic pollutants to water and soil.”

We recognized that upstream in the value chain (steel and plastics), both the degree of dependency on nature and the level of impact are generally higher compared to our Group’s domain. This is because the most upstream processes for steel and plastics involve activities such as crude oil extraction and mineral resource mining. Regarding dependencies, we recognized that these processes heavily depend on “rainfall pattern regulation” and “water purification.” Concerning impacts, we acknowledged that they significantly affect factors such as “emissions of toxic pollutants to water and soil.”

Future Initiatives

We conducted a pilot analysis and evaluation focusing on the Group’s automotive and motorcycle businesses, as well as upstream steel and plastics in the value chain. Through this analysis, 20 priority areas were identified within the Group.

In our assessment of dependencies and impacts, we confirmed that the TS TECH Group’s manufacturing processes have low dependencies on ecosystem services and that any negative impacts are minimal. However, we believe it is important to continue striving to reduce environmental impacts. The Group is advancing initiatives such as introducing environmentally friendly equipment and improving production efficiency to achieve its long-term environmental goals for 2050. In addition to forest conservation activities at each site, we have also launched unique programs like the TS TECH Fund, driving progress toward “coexistence with nature.” Going forward, we will advance our assessment of risks and opportunities based on the evaluation results obtained through this LEAP Approach and the Group’s current initiatives, striving to further promote biodiversity and natural capital responses.

Green Ecosystem Conservation Activities

The TS TECH Group is implementing activities tailored to each region’s characteristics to realize “coexistence with nature,” a key materiality focus. We continuously implement environmental conservation activities such as tree planting, thinning, and land preparation at all Group sites, including overseas, contributing to the preservation of the global environment.

Tree planting activity at TS TECH (THAILAND) CO., LTD.

Since 2011, we have been continuously advancing treeplanting activities in collaboration with local communities, aiming to restore damaged natural environments and combat climate change. By fiscal 2025, we had planted 23,099 trees to expand green spaces.

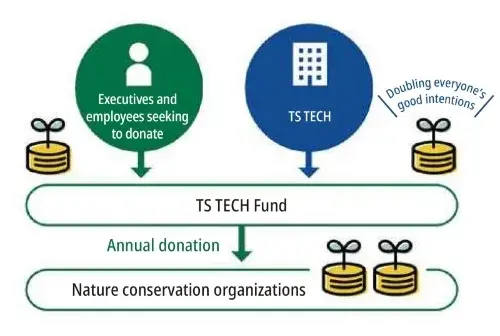

Support Activities Aimed at Coexisting with Nature

With the goal of “coexistence with nature,” the TS TECH Group operates the TS TECH Fund, a donation program for nature conservation organizations utilizing a matching gift system, We collect donations from officers and employees who support our activities, and the company matches these donations. This allows employees and the company to stand united in supporting nature conservation programs. For fiscal 2025, we made a donation to the Public Interest Incorporated Foundation The Nature Conservation Society of Japan. The donation will be used for activities including protecting endangered species and their habitats in Japan as well as initiatives for regional revitalization utilizing nature.

<Donation results for fiscal 2025>

| Recipient | The Nature Conservation Society of Japan Public Interest Incorporated Foundation |

|---|---|

| Donation amount | 3,965,600 yen |