Governance System and Risk Management

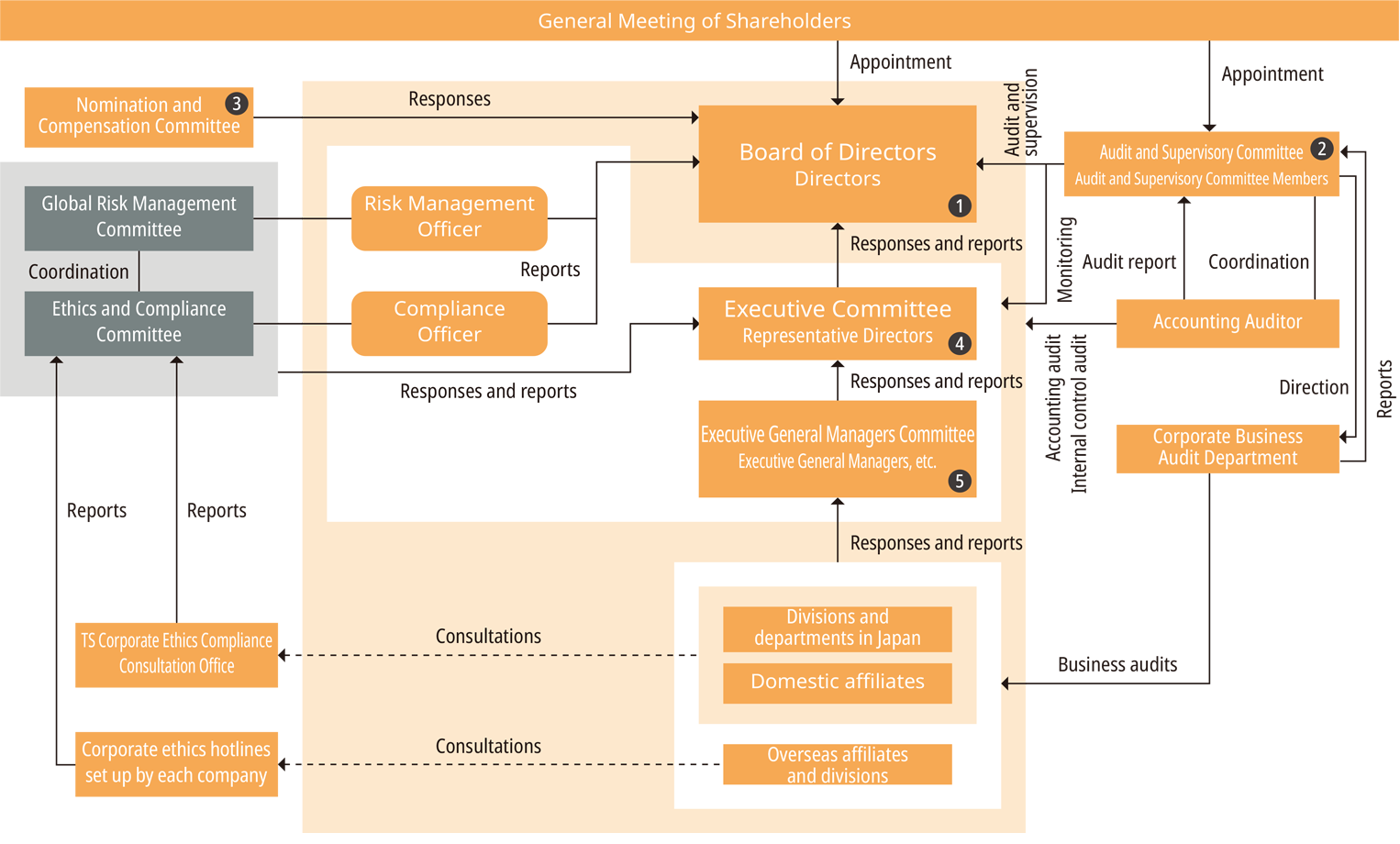

Governance System Diagram

| 1. Board of Directors | The Board of Directors is composed of seven directors (excluding directors who are Audit and Supervisory Committee members) and four directors who are Audit and Supervisory Committee members. The Board of Directors makes decisions regarding management policies, important management issues, and matters mandated by laws and regulations. It also supervises the execution of business operations. |

|---|---|

| 2. Audit and Supervisory Committee | The Audit and Supervisory Committee is composed of four Audit and Supervisory Committee members (three of whom are outside directors). Based on the audit policy established by the Audit and Supervisory Committee, it audits the execution of duties by the directors. |

| 3. Nomination and Compensation Committee | The Nomination and Compensation Committee is composed of two representative directors and three outside directors (of which two directors who are Audit and Supervisory Committee members). It deliberates on matters related to the appointment and dismissal of directors and executive officers and their compensation. |

| 4. Executive Committee | The Executive Committee comprises the company’s representative directors and directors working in Japan (excluding directors who are Audit and Supervisory Committee members). It conducts preliminary deliberations on such matters as resolutions to be put to the Board of Directors, and, within the scope of the authority assigned to it by the Board of Directors, discusses important matters relating to the execution of the duties of the directors. |

| 5. Executive General Managers Committee | The Executive General Managers Committee is made up of 13 executive general managers and regional general managers. This committee discusses policies, plans, and governance related to operations in each division to maintain efficient operations. |

Operation of an Internal Control System

The Board of Directors passed a resolution on the basic policies of TS TECH’s internal control system to meet the requirement to formulate regulations on internal controls stipulated in the amendment to Japan’s Companies Act in 2006. Since then, the Board of Directors has reviewed the implementation of this system each fiscal year and passed resolutions on changes to these policies as necessary at Board of Directors’ meetings. Additionally, in accordance with Japan’s Financial Instruments and Exchange Act, the TS TECH Group has established an internal control system to ensure the reliability of its financial reporting. The effectiveness of this system is maintained and internal control is enhanced through regular evaluations of improvements and operations and corrective actions when necessary.

Group Governance Structure

The TS TECH Group shares the TS TECH Philosophy, including its vision statement and mission statement, its basic policies on corporate governance and its approach to establishing internal control systems, and its management targets, striving to enhance its corporate governance structure.

Additionally, based on the standards stipulated by TS TECH, important management issues at subsidiaries must be reported to and approved by TS TECH and subsidiaries must also regularly report their earnings and financial status.

Furthermore, subsidiaries have established policies concerning organizational structure, division of duties, and authority, enabling swift decision-making and efficient execution of duties. We also conduct routine risk and compliance verification measures, and other risk mitigation activities alongside compliance promotion initiatives. Should the risk of losses materialize, we promptly collaborate with the company to minimize the impact.

The TS TECH Audit and Supervisory Committee, when necessary, collaborates with the internal audit departments and Audit and Supervisory Committee members of major subsidiaries to audit the execution of duties by directors of subsidiaries. Furthermore, our internal audit department conducts operational audits of major subsidiaries and evaluates internal controls related to financial reporting in accordance with the Audit and Supervisory Committee’s instructions and internal regulations, reporting its findings to the Audit and Supervisory Committee.

Compliance Framework

Based on the TS TECH Philosophy, the Group established the TS Standards for Conduct (TS TECH’s norms and ideals as an organization) and TS Guidelines for Conduct (expectations for day-to-day conduct for individual executives, officers, and employees). Regular education is provided to ensure the entire Group is familiar with these concepts.

A director or executive officer is appointed as a Compliance Officer in order to promote compliance initiatives, and steps are continually taken to prevent legal violations before they occur through regular TS TECH Corporate Governance (TSCG) selfverifications and deliberations of important ethics and compliance issues by the Ethics and Compliance Committee.

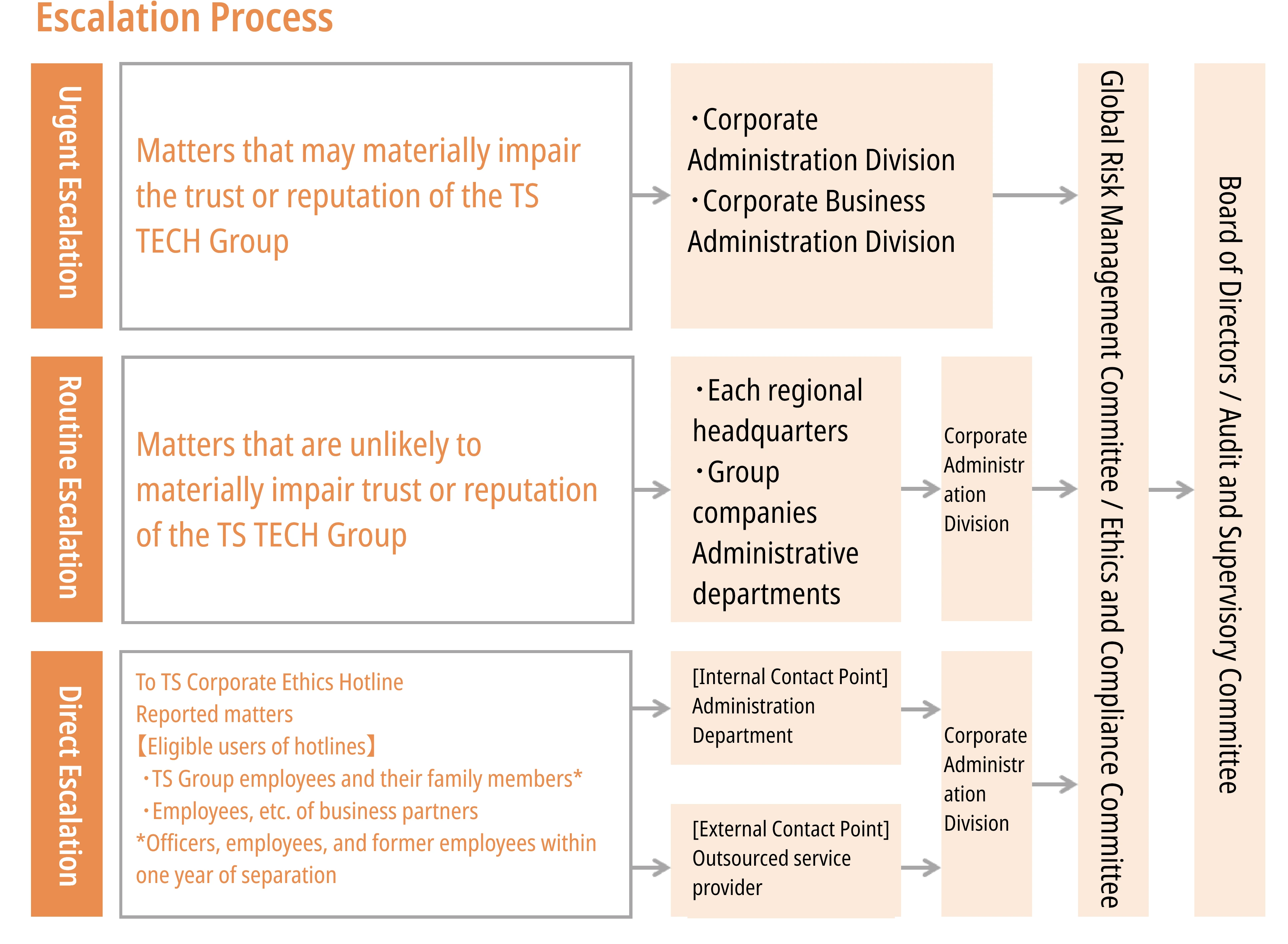

Additionally, we have established Corporate Ethics Hotlines as whistleblowing channels, operated by both an internal department and an external organization independent of TS TECH. When issues are identified, we promptly conduct fact-finding investigations and provide corrective guidance under the direction of the Compliance Officer. Anonymous reporting is permitted, and in accordance with the Whistleblower Protection Act, the confidentiality of reported information is strictly maintained. Disadvantageous treatment based on whistleblowing or cooperation with investigations is prohibited and violations of these provisions will result in disciplinary action. Furthermore, all inquiries and reports submitted to the hotlines are shared with the Ethics and Compliance Committee. The method for using the Corporate Ethics Hotlines is communicated internally to all employees through the Concept Manual distributed to all staff, posting on the company intranet, and rank-specific training programs. We are raising awareness among our business partners through poster displays.

During fiscal 2025, the Group received a total of 111 ethics and compliance cases, including inquiries made to our contact points, across all domestic and overseas subsidiaries and affiliates.

Accordingly, we appropriately implement corrective measures and disciplinary actions for all cases, including harassment, while maintaining continuous operations to foster self-cleansing within the company.

Ethics and compliance cases Number of cases recorded (Consolidated)

- Investigations into each case found no violations of laws or regulations that would have a significant impact on our business activities.

Risk Management Framework

Important management issues are carefully deliberated upon by TS TECH’s Executive Committee as well as various advisory committees. Ultimately, after deliberation by the Audit and Supervisory Committee, matters are reported to the Board of Directors, and TS TECH makes every effort to avoid and mitigate business risks.

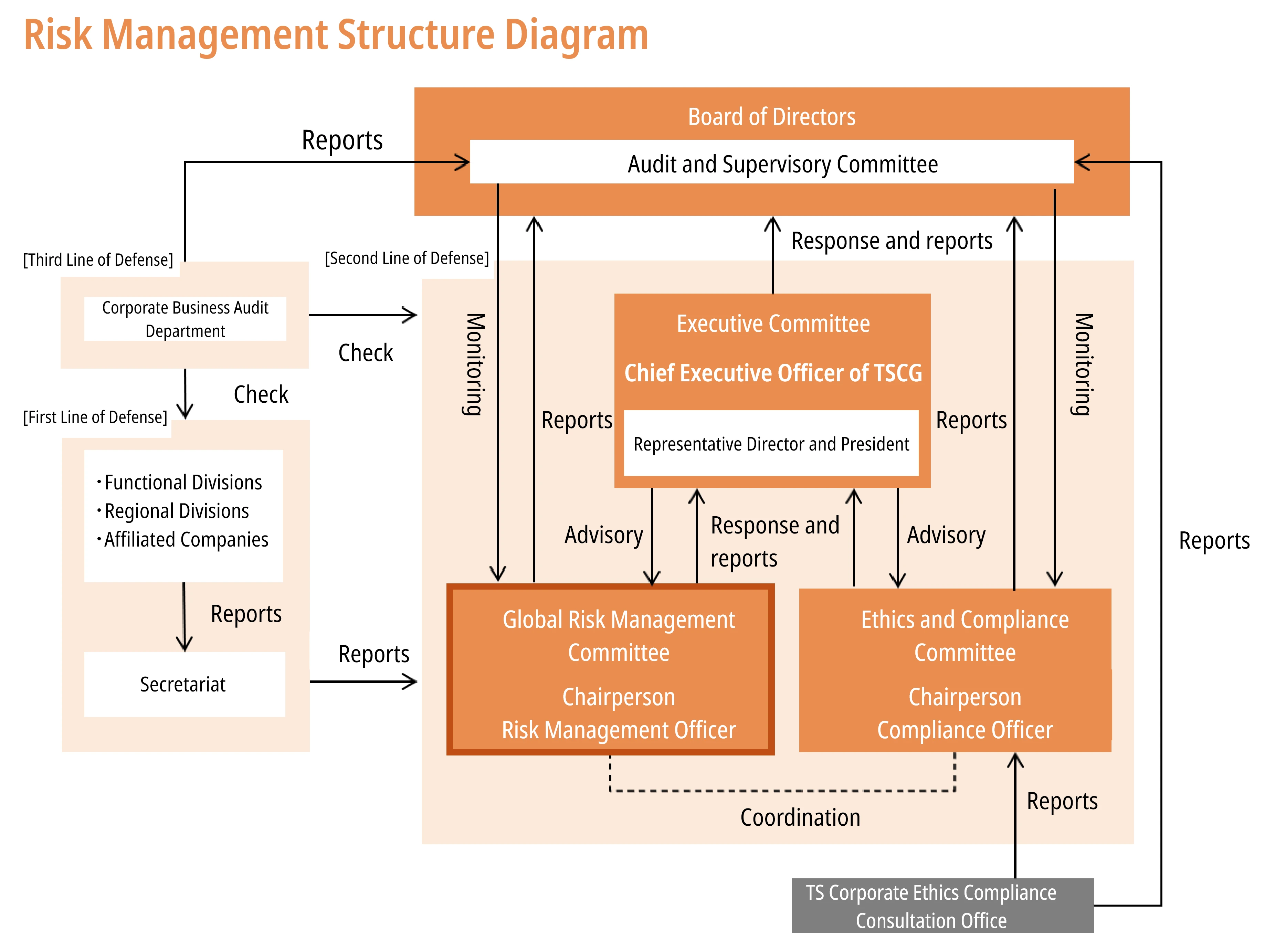

In addition, a Risk Management Officer is appointed from among the directors and placed in charge of risk management, and we have also established the Global Risk Management Committee, comprising directors and other officers. To prevent risks from materializing, we have implemented a management framework based on the “three lines of defense” model. Through the results of routine compliance and risk verification measures (hereinafter referred to as TSCG self-verification) and discussions on responses to serious risks affecting management that have been identified, we ensure that efforts are continually made to mitigate potential risks.

Additionally, we regularly conduct training sessions for all directors, led by outside legal counsel, covering risk management, compliance, and other relevant topics. Furthermore, for outside directors, we provide regular opportunities to explain the latest risk-related information, including the Group’s business activities, recent risk trends, and technological developments as well as the status of countermeasures for identified risks and the results of risk reviews. This ensures they can provide appropriate advice on risk management. As a related initiative, we are implementing e-learning programs such as risk management courses aimed at enhancing risk awareness for all employees.

Moreover, findings obtained through TSCG self-verifications are shared with internal audit departments so that they can be applied in risk approach auditing.

Global Risk Management Committee

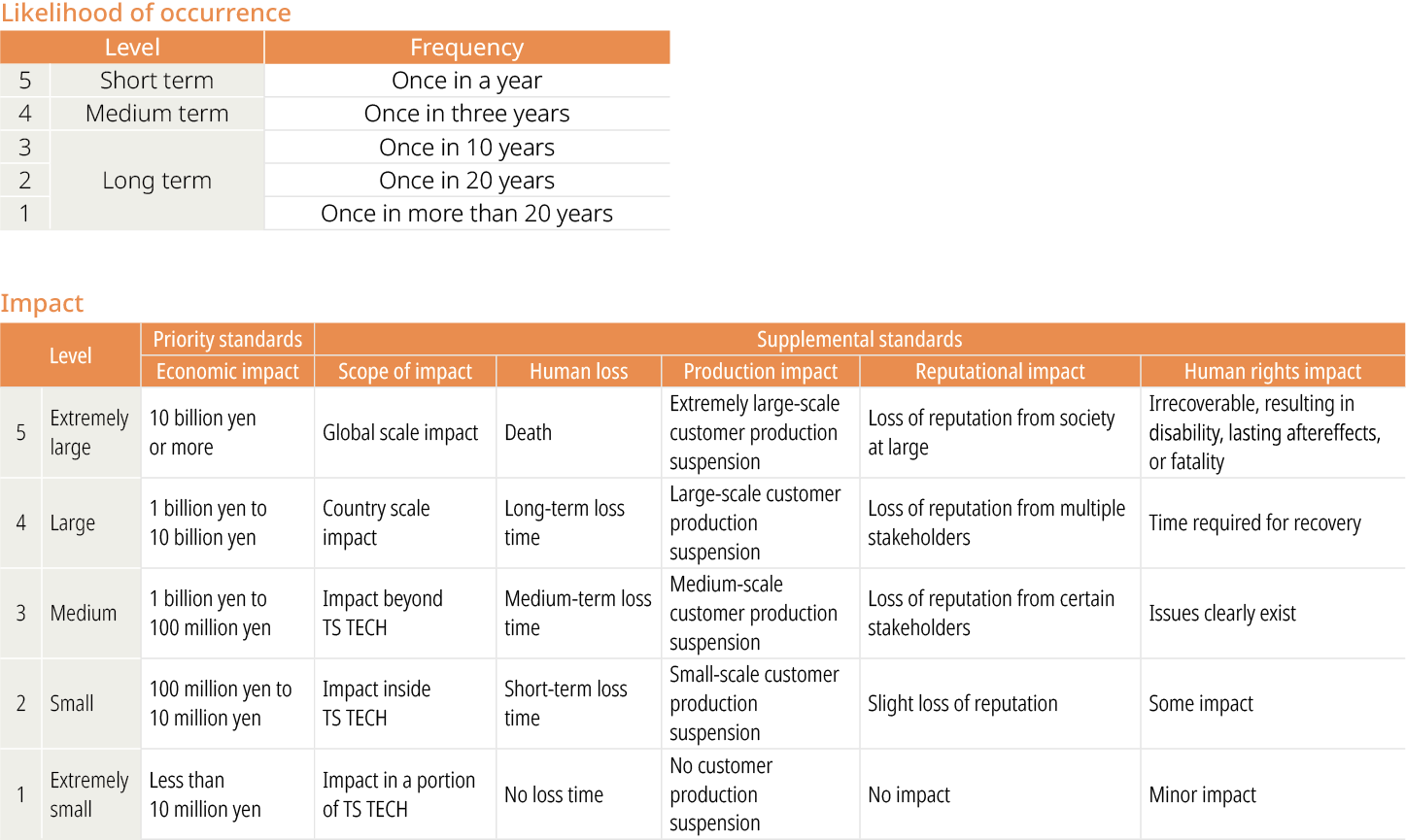

The Global Risk Management Committee was established as an advisory committee to the Executive Committee to help ensure appropriate identification and control of the various risks affecting global business activities in the 13 countries around the world where TS TECH operates, based on their likelihood of occurrence (expected frequency) and impact (potential magnitude) and to solidify the sustainability and stability of the business.

Specifically, each functional headquarters and regional headquarters conducts self-assessments once a year at the first line, reporting the results to the Global Risk Management Committee at the second line. The Global Risk Management Committee reviews the implementation status of risk countermeasures in the previous fiscal year, identifies ongoing and new risks, and selects material risks after conducting a phased assessment of the identified risks (initial assessment/secondary assessment, countermeasures/ progress confirmation, etc.).

In addition, by forming regional risk management committees in each region, risk specific to those geographic segments are identified and risk mitigation measures are promptly implemented. TS TECH has also worked to conduct emergency response training that anticipates a range of risks, such as the most frequently occurring natural disasters in each geographic region, or the outbreak of an infectious disease. The Corporate Business Audit Department, as the internal audit function, serves as the third line of defense. Operating independently from the first and second lines, it objectively verifies risk management systems and initiatives, including their frameworks and implementation status. For fiscal 2025, we identified five major risks and advanced risk mitigation measures.

Risk identification process

Self-assessment implementation

(1) Identify risks within each department and company

(2) Evaluate identified risks (likelihood of occurrence × impact)

(3) Aggregate post-countermeasure evaluations as “residual risks”

■ Residual risk organization & identification of Group material risks

(4) Organize by causal factors

• Risks stemming from internal factors such as the environment of each Group company

• Risks stemming from external factors including social conditions

(5) Primarily for risks stemming from external factors, identify “Regional risks” requiring response based on regional characteristics and “Material risks” requiring response across the entire Group

Five Major Risks

-

Crisis Management in Emergencies

-

[Target]

Communicable & infectious diseases/virus/wind or flood damage/ earthquake/conflict/riots or terrorism - [Main measures]

- Continuous implementation of natural disaster response training

- Survey of disaster preparedness supplies stockpile status and replacement of supplies

-

-

IT Security

-

[Target]

Leakage or loss of information and cyberterrorism - [Main measures]

- Continuous implementation of security education and drills for responding to targeted email attacks

- Cybersecurity countermeasures

(Enhanced monitoring systems, strengthening initial response, establishment of Computer Security Incident Response Team

(CSIRT) structure)

-

-

Stoppage of Parts Supply

-

[Target]

Raw material supply shortages/production capacity shortages/ supplier bankruptcy - [Main measures]

- Strengthen supply chain management to ensure stable procurement of components

- Enhance monitoring of supplier-side financial risks

-

-

Stoppage of Production

-

[Target]

Machinery and equipment failure/trade-related, import–export issues - [Main measures]

- Strengthen production equipment management system

-

-

Fires

-

[Target]

Fire sources:

Welding/electric leakage or current surge/hazardous materials - [Main measures]

- Inspection based on Group-wide integrated items and crosscutting management by the department responsible

- Expert validation and implementation of on-site education

-

Acquisition of TISAX certification

To mitigate the risk of information leaks, the TS TECH Group strives to maintain internal rules and regulations, carry out thorough employee training, and enhance security and network monitoring systems. It also implements comprehensive information management through means such as maintaining environments that reflect the security requirements of individual customers and earning Trusted Information Security Assessment Exchange (TISAX) certification* at 6 of our 35 consolidated subsidiaries (as of August 2025).

- TISAX: The information security standard for the automotive industry, it is a system for screening by a certification agency based on the German automobile industry association Verband der Automobilindustrie (VDA)’s information security assessment (ISA) standards.