Value Creation Story

2030 vision

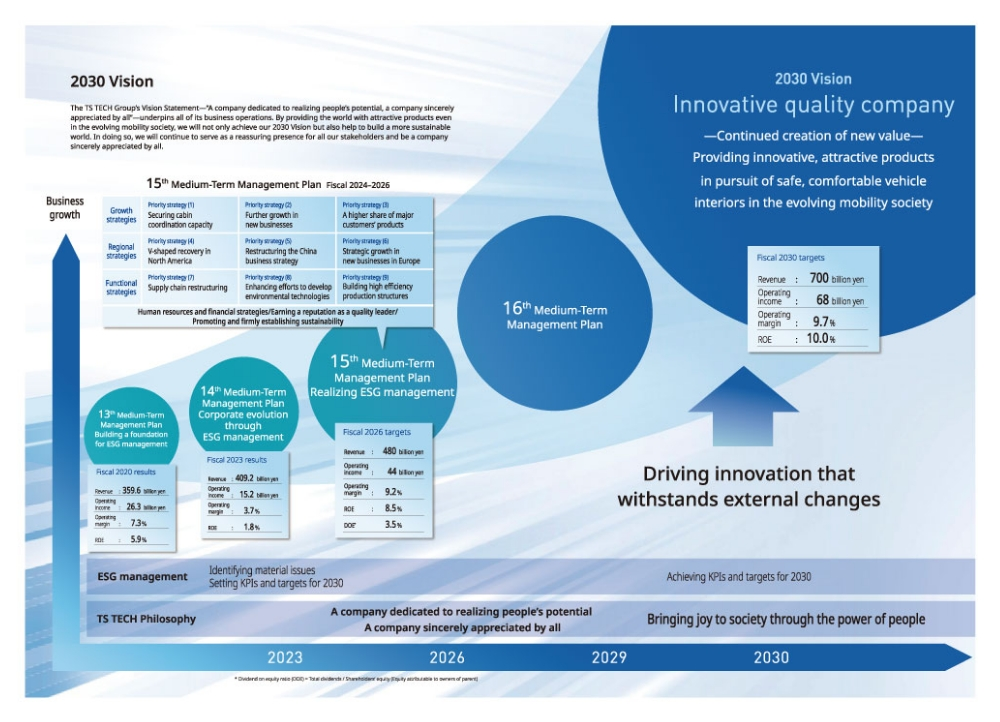

The TS TECH Group’s Vision Statement—“A company dedicated to realizing people’s potential, a company sincerely appreciated by all”—underpins all of its business operations. By providing the world with attractive products even in the evolving mobility society, we will not only achieve our 2030 Vision but also help to build a more sustainable world. In doing so, we will continue to serve as a reassuring presence for all our stakeholders and be a company sincerely appreciated by all.

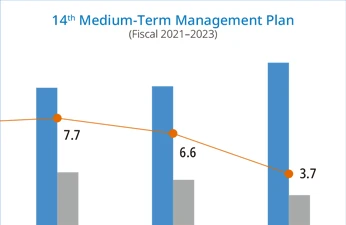

Review of the 14th Medium-Term Management Plan

The 14th Medium-Term Management Plan set out a management policy of “Corporate evolution through ESG management,” and during those years we moved forward with efforts to strengthen our corporate structure in various ESG-related areas that support business growth. We made progress on priority measures, but the extremely challenging business environment caused by the pandemic and material supply shortages left outstanding issues in terms of profitability. We will implement the 15th Medium-Term Management Plan to ensure that all remaining challenges are addressed, such as achieving as yet unattained commercial rights targets in new business areas and remedying the downturn in capital efficiency.

Progress on Priority Measures

*chart can be scrolled left and right.

◎: Very good 〇: Good △: Average

| Measure | Evaluation | Notable initiatives | |

|---|---|---|---|

| Evolution for business growth |

Commercialization of original technologies | ◎ |

|

| Expansion of strategic commercial rights | △ |

|

|

| Optimization of business operations structure | ◯ |

|

|

| Contribution to a sustainable society | ◎ |

|

|

| Stronger business operations structure to support evolution |

Recognition for top quality | △ |

|

| Strengthening of continuous earnings structure | ◎ |

| |

| Maximization of employee and structural efficiency | ◎ |

|

Financial Trend

*chart can be scrolled left and right.

|

|

|

|||||

| Fiscal 2020 results | Fiscal 2021 results | Fiscal 2022 results | Fiscal 2023 results | Fiscal 2024 plan | |||

|---|---|---|---|---|---|---|---|

| Revenue (Billion yen) |

359.6 | 346.1 | 349.9 | 409.2 | 410 | ||

| Operating income (Billion yen) |

26.3 | 26.7 | 22.9 | 15.2 | 20 | ||

| Operating margin | 7.3% | 7.7% | 6.6% | 3.7% | 4.9% | ||

| ROE | 5.9% | 7.8% | 4.3% | 1.8% | 3.4% | ||

| Average exchange rate | [USD] | 108.7 | 106.1 | 112.4 | 135.5 | 130.0 | |

| [CNY] | 15.6 | 15.7 | 17.5 | 19.8 | 19.0 | ||

Non-Financial Trend

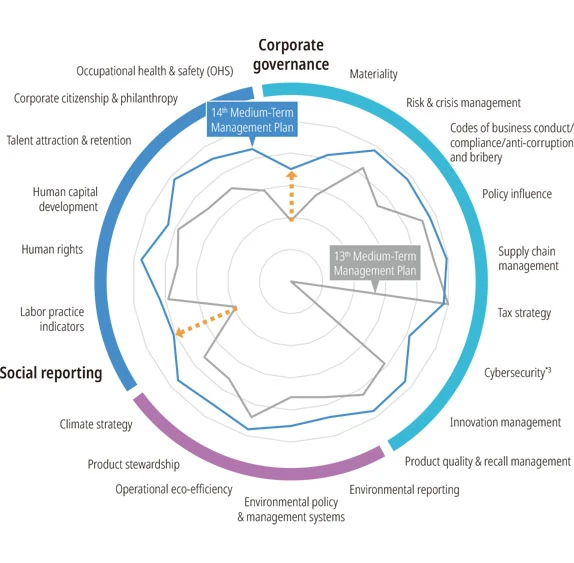

The TS TECH Group measures its ESG quality using an evaluation method based on the Dow Jones Sustainability Indices (DJSI)*1

In the 14th Medium-Term Management Plan, our governance reforms, including becoming “a company with an Audit and Supervisory Committee” structure and enhanced disclosure of non-financial items, were all well received. This meant that we significantly improved our scores in the domains of corporate governance and social reporting. We will continue to move forward with advanced ESG management, which we highlighted as a challenge in the 13th Medium-Term Management Plan (fiscal 2018–2020), as we strive to build an industry-leading corporate structure and deliver sustainable corporate growth.

DJSI Evaluation (Indicated as a percentile ranking within the auto parts industry*2)

- A sustainability-related index that evaluates companies’ sustainability from ESG and economic perspectives, published annually by S&P Dow Jones Indices LLC of the United States

- Indicates the company’s position in the industry, with the highest score being 100

- New item from fiscal 2021, so no score recorded for the 13th Medium-Term Management Plan

Major Initiatives

E

- Endorsement of TCFD recommendations and disclosure response

- Enhancing environmental management and CDP initiatives

S

- Implementation of employee engagement survey

- Expanded the deployment of Supplier Sustainability Guidelines and the scope of surveys about the guidelines

G

- Transition to “a company with an Audit and Supervisory Committee” structure

- Establishment of the Nomination and Compensation Committee

- Diversification of the Board of Directors (appointment of female directors, etc.)

- Establishment of the Sustainability Committee

- Formulation of material issues and setting of 2030 targets

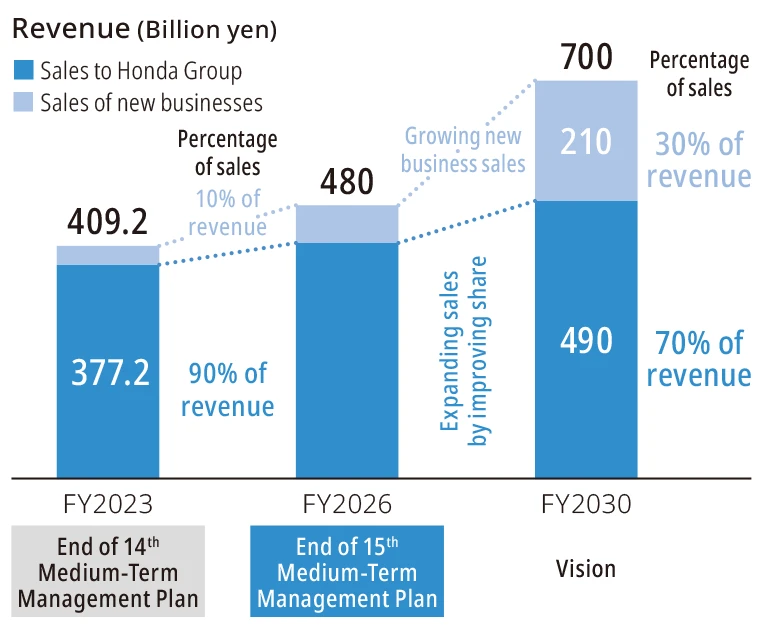

Outline of the 15th Medium-Term Management Plan

Under the 15th Medium-Term Management Plan, we are first of all focusing on the challenge of recovering profitability as soon as possible, to achieve further growth and deliver on our 2030 Vision. To do this, the plan sets out nine key strategies, comprising growth, regional and functional strategies. We also aim to help to build a sustainable world, as the ESG management initiatives we have been implementing since the 13th Medium-Term Management Plan culminate, and always seek to be a reassuring presence for our stakeholders and “A company sincerely appreciated by all.”

*chart can be scrolled left and right.

| Financial targets | 14th Medium-Term Management Plan results |

15th Medium-Term Management Plan targets |

2030 targets |

|---|---|---|---|

| Revenue (Billion yen) | 409.2 | 480 | 700 |

| Operating income (Billion yen) | 15.2 | 44 | 68 |

| Operating margin | 3.7% | 9.2% | 9.7% |

| ROE | 1.8% | 8.5% | 10.0% |

| Shareholder returns | |||

| Basic policy | Implementing sustained, stable returns unaffected by business results | ||

| Dividends | Stable increase in dividend payments, targeting DOE of 3.5% or more by the end of the 15th Medium-Term Management Plan | ||

| Acquisition of treasury stock | Flexible share buyback during the term of the 15th Medium-Term Management Plan amounting to cumulative total of 20 billion yen and appropriate retirement of treasury stock | ||

| Management policy Realizing ESG management | ||

|---|---|---|

| Priority strategies | Notable initiatives | |

| Growth strategies | Securing cabin coordination capacity |

|

| Further growth in new businesses |

|

|

| A higher share of major customers’ products |

|

|

| Regional strategies |

V-shaped recovery in North America |

|

| Restructuring the China business strategy |

|

|

| Strategic growth in new businesses in Europe |

|

|

| Functional strategies |

Supply chain restructuring |

|

| Enhancing efforts to develop environmental technologies |

|

|

| Building high efficiency production structures |

|

|

| Foundation | Human resources strategies/ Financial strategies /Earning a reputation as a quality leader/Promoting and firmly establishing sustainability | |

|---|---|---|

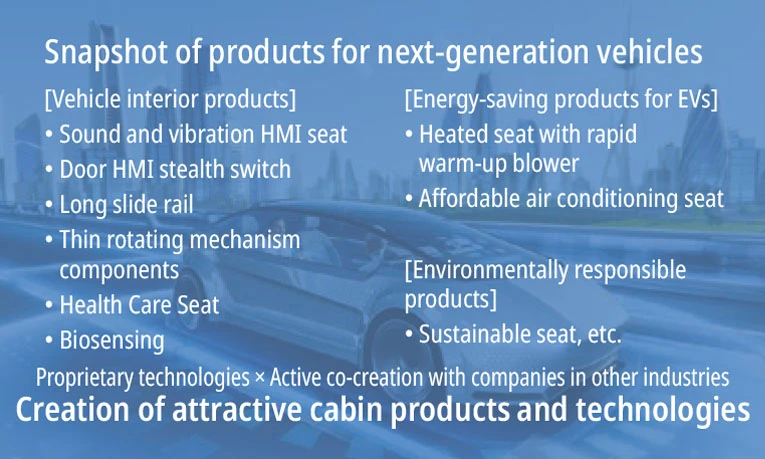

Changes in automobiles brought about through technological innovation will transform the value required of vehicle interiors. In order to seize this business opportunity and translate it into further business growth, it is imperative to be able to coordinate not only seats but the entire cabin, proposing new value to customers and users. We will work to create products and technologies that, put together, can deliver attractive cabins, utilizing both our accumulated proprietary technologies and collaboration with companies in other fields.

The TS TECH Group has to date achieved steady business growth, serving as a global partner to Honda Motor Co., Ltd. and its affiliates in the Honda Group. In order to achieve further growth, we aim to achieve our 2030 Vision not by securing a higher share of major customers’ (Honda Group) business but also by ensuring further growth in new businesses, for instance by acquiring new customers and commercial rights outside the Honda Group.

2030 targets

- Automobile seat share for the Honda Group above 70%

- New business sales accounting for more than 30% of consolidated revenue